Back in Dec 2011, I posted my Dax index outlook using Elliott Wave analysis, more with an intention to teach how we could apply the Elliott wave Principle than to forecast. I proposed a bearish count, but the index recovered more than anticpated. Now is a good time to review the movements from the low posted in September 2011.

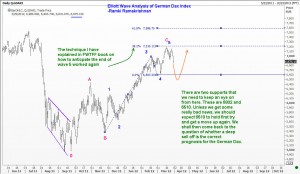

I am continuing to label the first rally up as wave A for now. Remember that all Elliott Wave labels are work in progress. We will make changes as the market unfolds. The idea is to give ourselves an edge, a system, that will tell us we are wrong much sooner than otherwise. Observe from the chart that we have likely finished a 5 wave rally from the (potential) wave B bottom. If this 5 wave rally is a C wave (and not a 3rd wave) we will eventually get an overlap on the top of wave A to confirm a bearish count. However, I tend to be careful at these levels.

There are two supports that we need to keep an eye on from here. These are 6802 and 6510. Unless we get some really bad news, we should expect 6510 to hold first try and get a move up again. We shall then come back to the question of whether a deep sell off is the correct prognosis for the German Dax.