by Ramki | Feb 29, 2024 | Bitcoin

I have just published an article on Forbes.com on this subject. Here is the Link: https://www.forbes.com/sites/greatspeculations/2024/02/28/what-is-the-next-target-for-bitcoin

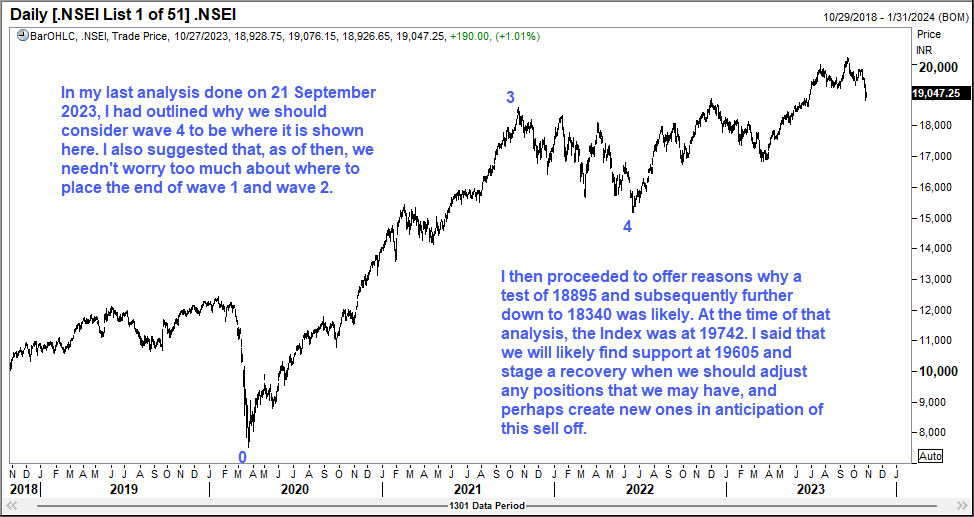

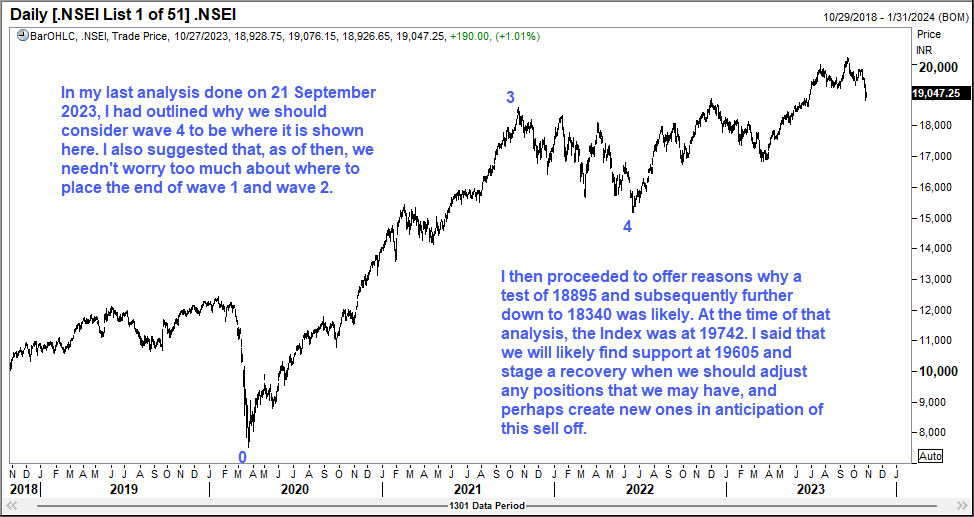

by Ramki | Oct 28, 2023 | India

28 October 2023 The following is the first page of a fresh analysis that is available for members of WaveTimes. Please see wavetimes.net/consulting for details of this service.

by Ramki | Oct 1, 2023 | Uncategorized

1 October 2023 When I returned to India a few years ago, I became a SEBI Registered Investment Adviser and a SEBI Registered Research Analyst. However, because of the onerous compliance requirements under the regulations, I first surrendered the Investment Adviser...

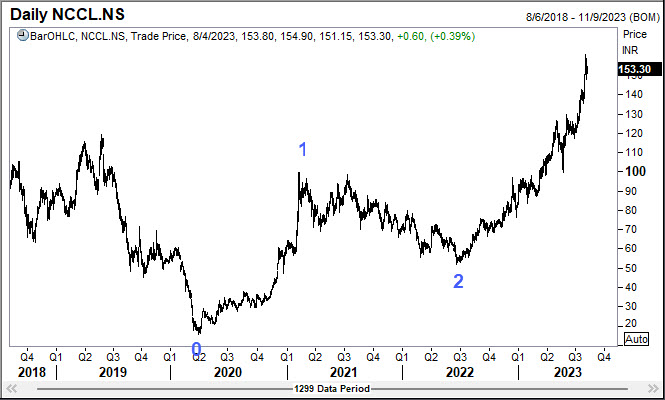

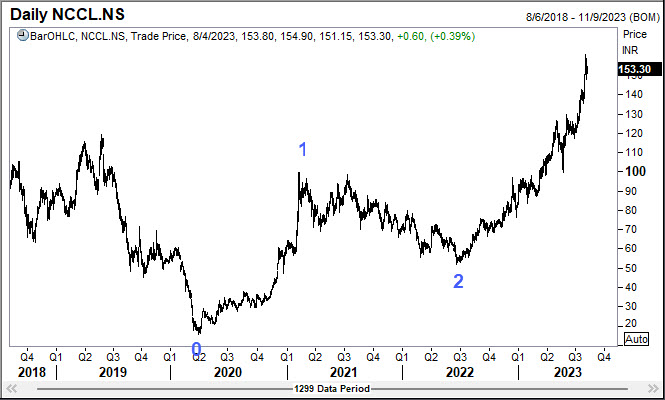

by Ramki | Aug 5, 2023 | Indian Stocks Trading, Ramki's Watchlist

NCC Limited is an India-based company engaged in construction/project activities in the infrastructure sector. The company has been reducing its debt, maintaining about 22% dividend payout, and has a good profit growth of 25% CAGR over the last 5 years. But more than...

by Ramki | Jul 17, 2023 | Indian Stocks Trading

The Indian stock Exide Industries Ltd seems poised to continue its bull run, and Elliott Wave Analysis tells me we have at least another 8% on the upside. My approach tells me that dips to 242 and 232 are where the charts point to immediate supports, and if I were to...