As you probably know from this link wavetimes/raves, Forex traders from around the world pay special attention to the levels I discuss using Elliott Waves. Earlier this year, several members of the premium service had subscribed to my analysis of USD/JPY. I was recommending them to buy at 111.40, looking for a move back to at least 113. I don’t know what happened (probably some fund manager on my list moved in slightly ahead with a huge buy order), the USD/JPY turned 20 pips too soon, and from 111.60, it went to 114.95.

Although I was not obliged to do anything more, I sent these members another email and some more charts, but this time, it was of EURUSD. The charts that pertained to the short term at that time are produced for your learning. See the date on my email! It is 22 Feb 2017.

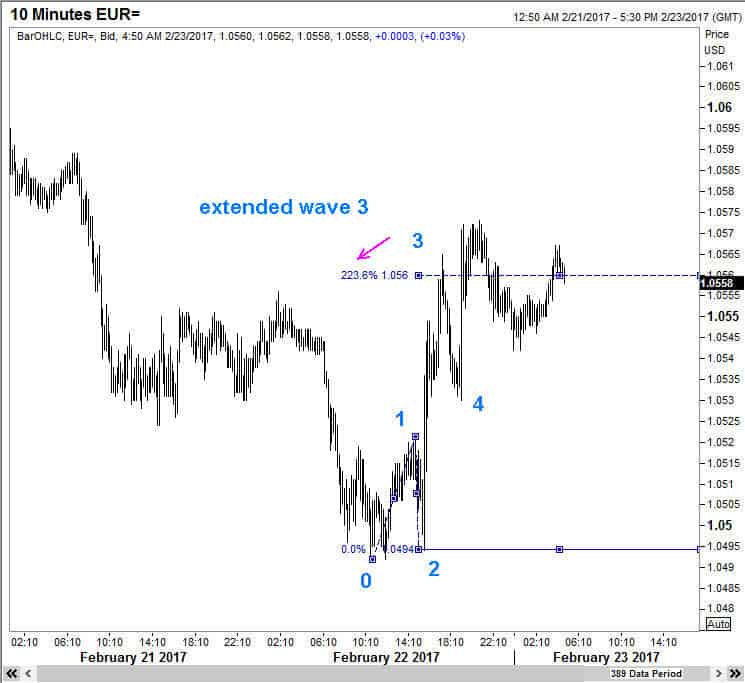

By 23 Feb, 2017, the minor wave 3 of EURUSD had extended to reach above 223.6% of minor wave 1. The low for wave 1 was 1.0492

You will also notice that we had retested 1.0494 a second time.

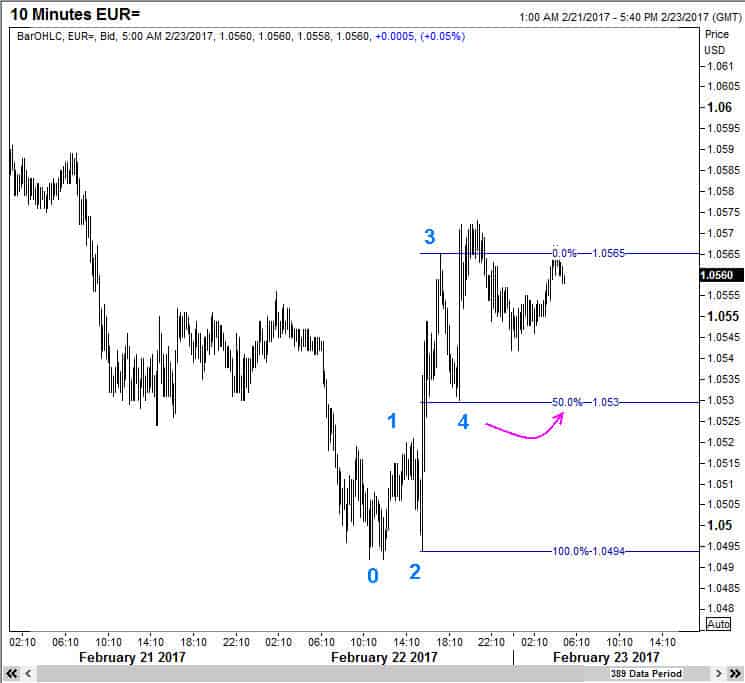

Observe how wave 4 in EURUSD came down to the 50% retracement level.

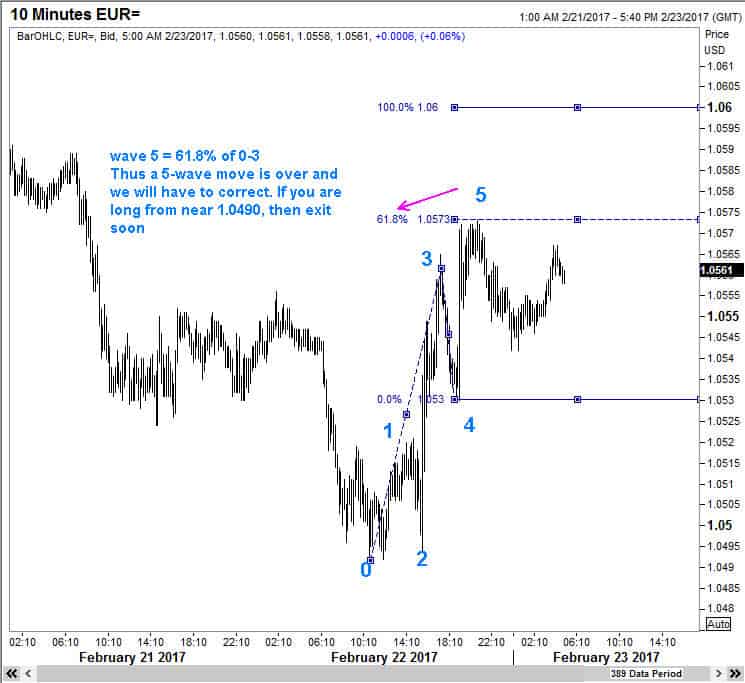

I also suggested taking some profits when we reached the targets for wave 5

Incredible as it may seem to the uninitiated, the EUR/USD topped out at 1.0630 and came down by 2 March 2017 to what level? Yes, it was 1.0492.

And where do you think it went from there?

If you have serious money at risk, then getting the right kind of advice is a no brainer. Often, I get investors and traders approaching me after their position becomes bad. While I do everything to help them manage these positions, they would have saved themselves a huge pile of money if only they had asked before moving in. The cost-benefit advantage is so much in your favor that one need not labor the point.