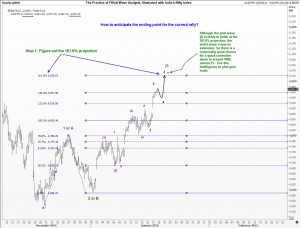

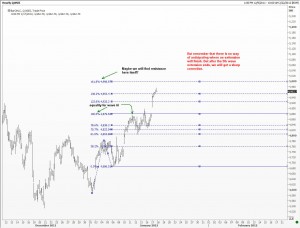

I have been receiving several messages from traders who seem to have fallen prey to the age old impulse of selling into a rally, when everything we know tells us to be patient to buy the dip. The fact that the dip did not materialize should not be the excuse to sell! You should always ask yourself what is the major direction that we want to be trading? If we are looking for a dip of 100 points to go long for a move of 600 points, does it make sense to sell after a recovery of 150 points?? THis is what many traders have done in the last few days with India’s Nifty. It doesn’t matter if you have no position in that market. Just see how I would deal with an error like that, and learn from it.As always, there are comments posted directly on the chart. Enjoy.(PS These are the same techniques I have taught you in the book “Five Waves to Financial Freedom”)

I have been receiving several messages from traders who seem to have fallen prey to the age old impulse of selling into a rally, when everything we know tells us to be patient to buy the dip. The fact that the dip did not materialize should not be the excuse to sell! You should always ask yourself what is the major direction that we want to be trading? If we are looking for a dip of 100 points to go long for a move of 600 points, does it make sense to sell after a recovery of 150 points?? THis is what many traders have done in the last few days with India’s Nifty. It doesn’t matter if you have no position in that market. Just see how I would deal with an error like that, and learn from it.As always, there are comments posted directly on the chart. Enjoy.(PS These are the same techniques I have taught you in the book “Five Waves to Financial Freedom”)

The Practice of Elliott Wave Analysis

Unleash your Potential

Transform your trading – Starting Today