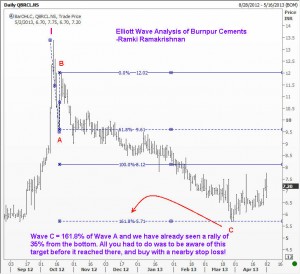

The stock market provides ample opportunities to make money. All you need to do is to stay alert, and have a watch list of stocks that you wish to be involved in. Typically, these stocks should be well traded, i.e. there should be wide participation in order for Elliott Waves to work. In my Premium Service, we only look at well traded stocks. However, the technique works well in most traded instruments. In today’s example, I will show you two charts of Burnpur Cements. I really dont know if this is a well traded stock, but when I was scrolling down the Indian Stocks alphabetically, and managed to reach “B”, this stock looked interesting. So I did some quick analysis and thought of sharing with you. You can see that I haven’t done the extensive analysis that usually goes in to my recommendations. This example is only to show you what is possible if you remain alert, meaning you should not quickly run to the market to buy this stock without doing a full analysis. Elliott Waves works wonderfully well in the stock markets too. However, don’t be fooled into thinking that all you need to know is how to compute a few Fibonacci ratios and extensions. Elliott Waves is more than that. I normally use Fibonacci relationships to confirm my wave count and to compute targets (not the other way around!). With best wishes

Stay alert to profit

Unleash your Potential

Transform your trading – Starting Today