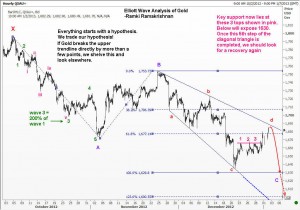

Hello everyone..as promised, I will share with you an occasional trade that was sent to the members of the exclusive club. On 3rd January I had recommended trying long EURUSD around 1.3110 with a 30 pip stop, I was betting that we will get a fifth wave type recovery, notwithstanding the fact that there were negative divergences in the daily chart. The support at 1.3080 held for a few hours, and the currency pair bounced around a bit. But eventually it gave way and went all the down to 1.2998. So yes, we had taken a small loss there. I am mentioning this here so you realize that WaveTimes is very transparent. We never trade with a rear-view mirror! Our aim is to capture a good move while keeping losses under control. I had also sent to the members the first chart below, suggesting that Gold will experience weakness from around 1690 and head to 1630. Take a look.

And sure enough, after a brief struggle above 1690, it came off quite aggressively to 1627. Here is the current chart of Gold.

I have recently posted a trade idea covering an Indian stock. (By the way, I now have a direct bank transfer option for members from India). This year promises to be exciting. Our mission is to be alert to low-risk trades. The key to success lies in taking signals whenever they show up. Some will work, some will fail. But those that succeed will work very well, and more than offset the setbacks. There are few approaches that work as well as Elliott Waves. Combine that with sound money management, and you have an edge that is invaluable. All the best in 2013.