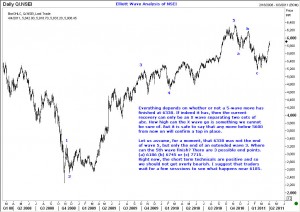

Everything depends on whether or not a 5-wave move has finished at 6338. If indeed it has, then the current recovery can only be an X wave separating two sets of abc. How high can the X wave go is something we cannot be sure of. But it is safe to say that any move below 5600 from now on will confirm a top in place.

Everything depends on whether or not a 5-wave move has finished at 6338. If indeed it has, then the current recovery can only be an X wave separating two sets of abc. How high can the X wave go is something we cannot be sure of. But it is safe to say that any move below 5600 from now on will confirm a top in place.

Let us assume, for a moment, that 6338 was not the end of wave 5, but only the end of an extended wave 3. Where can the 5th wave finish? There are 3 possible end points. (a) 6186 (b) 6745 or (c) 7715.

Right now, the short term technicals are positive and so we should not get overly bearish. I suggest that traders wait for a few sesssions to see what happens near 6185. There will be several low-risk trades in the future, and it is better to wait for a clear signal (such as the one that emerged when the index traded below 6069 earlier this year) before risking hard-earned money in the markets.