Having prepared this on the 15th, with an intention of sharing with readers the same evening, I went out for a walk. I suddenly remembered that I had promised my wife that we will go to the movies, and promptly forgot that this update was ready! Anyway, we are still not too far from where we were on the 15th, So here goes.

Having prepared this on the 15th, with an intention of sharing with readers the same evening, I went out for a walk. I suddenly remembered that I had promised my wife that we will go to the movies, and promptly forgot that this update was ready! Anyway, we are still not too far from where we were on the 15th, So here goes.

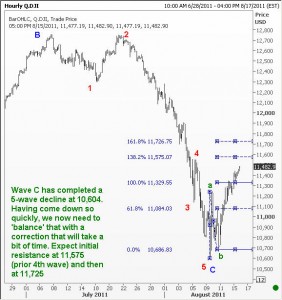

In the big picture, we should still lookout for a move down to 9970. ANy failure to move and stay above 11725 will see the next round of sell off. Indeed, we could even fail near the prior fourth wave at 11,575. So take care.