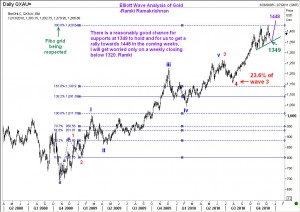

There have been several requests for my outlook on Gold. The attached chart gives you the Elliott Wave Analyst’s view of where the precious metal is likely to go in the coming weeks. As you can see, Gold has experienced a bout of profit-taking at the 300% fibonacci extension target. However, the current setback for Gold is still viewed only as a correction. During this phase, expect initial supports to come in around 1368, but the crucial support really lies at 1320. I expect Gold to find fresh buyers on any dip to 1349/50 levels, which is where a minor trendline support comes. The next rally will take us to new record highs, and will reach 1448. The technical equality target lies at 1460, and so we could experience a brief spike to that level, but at present, traders should be quite content with taking profits at 1448 or thereabouts. Thus, the forecast for Gold prices is to remain bullish, and buy on dips.

There have been several requests for my outlook on Gold. The attached chart gives you the Elliott Wave Analyst’s view of where the precious metal is likely to go in the coming weeks. As you can see, Gold has experienced a bout of profit-taking at the 300% fibonacci extension target. However, the current setback for Gold is still viewed only as a correction. During this phase, expect initial supports to come in around 1368, but the crucial support really lies at 1320. I expect Gold to find fresh buyers on any dip to 1349/50 levels, which is where a minor trendline support comes. The next rally will take us to new record highs, and will reach 1448. The technical equality target lies at 1460, and so we could experience a brief spike to that level, but at present, traders should be quite content with taking profits at 1448 or thereabouts. Thus, the forecast for Gold prices is to remain bullish, and buy on dips.

Outlook for Gold 13 Dec 2010

Unleash your Potential

Transform your trading – Starting Today