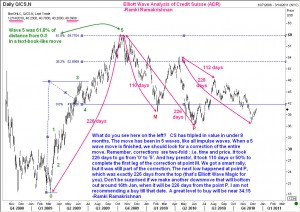

The outlook for banking giant Credit Suisse ( CS.N) is not as straight forward as that for Citigroup. However, there are plenty of interesting things you can see in the attached chart of Credit Suisse ADR.

The outlook for banking giant Credit Suisse ( CS.N) is not as straight forward as that for Citigroup. However, there are plenty of interesting things you can see in the attached chart of Credit Suisse ADR.

Clearly, when you get a huge rally in a short period of time, the ensuing correction will invariably take long. That is also one of the application of the ‘alternation’ principle that you would have surely read about when studying the Elliott Wave Principle. THe relationship between the various moves in the stock price of Credit Suisse shows that there is value for the careful investor to spend time in such analysis as shown here. To cut a long story short, it might be safer for the investor to wait for a few weeks more to see how Santa Claus deals with the US equity markets. If there is any downside surprise anywhere, then use dips to the low 34s to buy this stock, and be alert especially around 16th January. Remember, money not lost is as good as money made!

Outlook for Credit Suisse ADR: CS.N

Unleash your Potential

Transform your trading – Starting Today