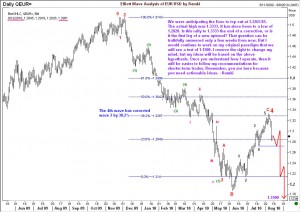

Long time followers of my Elliott Wave analysis know that I propose an idea, and then follow it faithfully until proved wrong. The value of this approach is it allows us to take low-risk positions, while always remembering that we could be wrong. It has been my view that the long-term target for the EUR/USD lies below 1.1700, potentially around 1.1500. However, the road to that goal is more than bumpy. Technically, the recovery to 1.3333 could be interpreted in many ways. My current approach is to call it the end of the 4th wave. (see update of 18th July) Hence we should get the 5th wave. However, there is always a chance that the rally was the first wave of a new uptrend. Our endeavor is to figure out a way to trade this without getting killed. I expect the trading range for the next few days to be 1.2680-1.3080. Hopefully we will get additional clues about the market as we unfold. I will try and post as soon a low-risk opportunity shows up in EUR/USD.

Long time followers of my Elliott Wave analysis know that I propose an idea, and then follow it faithfully until proved wrong. The value of this approach is it allows us to take low-risk positions, while always remembering that we could be wrong. It has been my view that the long-term target for the EUR/USD lies below 1.1700, potentially around 1.1500. However, the road to that goal is more than bumpy. Technically, the recovery to 1.3333 could be interpreted in many ways. My current approach is to call it the end of the 4th wave. (see update of 18th July) Hence we should get the 5th wave. However, there is always a chance that the rally was the first wave of a new uptrend. Our endeavor is to figure out a way to trade this without getting killed. I expect the trading range for the next few days to be 1.2680-1.3080. Hopefully we will get additional clues about the market as we unfold. I will try and post as soon a low-risk opportunity shows up in EUR/USD.

Medium Term Elliott Wave Analysis EUR/USD

Unleash your Potential

Transform your trading – Starting Today