There have been persistent requests from my readers in India for articles on how to use Elliott Waves to invest in Indian stocks, and this post looks at Hindalco. Let us start from the February 2016 low of 58.80. A lot of traders would have been reluctant to buy Hindalco when it was falling like nobody’s business. But in the short span of six months, Hindalco has already reached the 150 level, returning 150%. Such spectacular returns go only to the astute investor, who lies patiently in wait for the right opportunity and goes in aggressively.

The careful investor

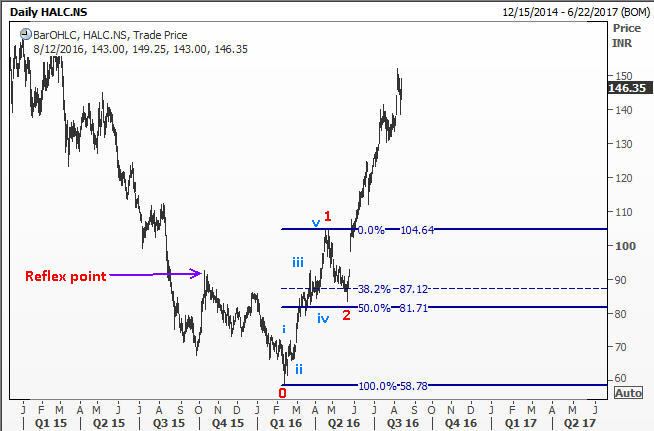

You don’t always have to be picking the bottoms to make money. You could have invested in Hindalco at the right time using Elliott Waves at many junctures on the way up. In my book ‘Five waves to Financial Freedom” , I have discussed the concept of reflex point. Once Hindalco went past the reflex point in a five wave move, the careful Elliott Wave investor would have watched the stock on a daily basis to see when he could join in the upcoming third wave. The first chart below shows the reflex point as well as the five wave rally that took it past that point.

You can see from the above chart that wave 2 was brief, falling only slightly below the 38.2% retracement level. When the explosive rush to the upside happened with a gap and an expansion in volume, you would have immediately committed some funds. That is because you now know that wave 3 is very likely underway.

Buying in the midst of a third wave

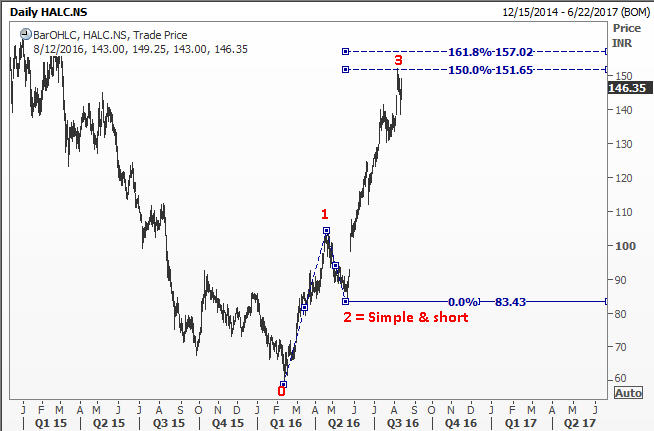

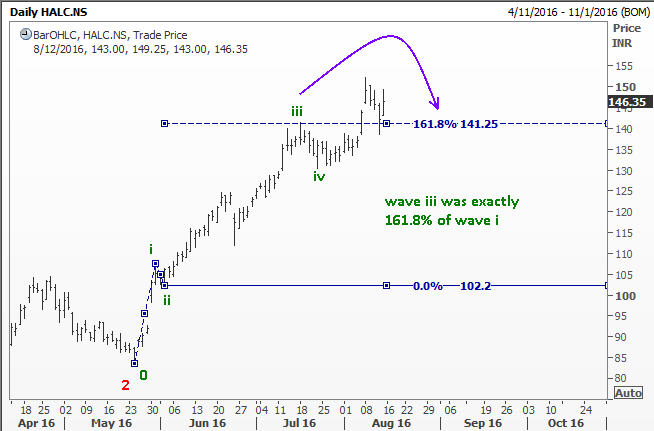

I teach many strategies for real-time trading in my seminars and workshops. Today, you get a snippet. Read this post as well as the one below (Walldan Group Inc analysis) and you will see what I am hinting at. The following two charts suggest that Hindalco could have potentially reached the end of an extended third wave. Mark my choice of words! I try to remind myself everyday that no matter how smart I think I am, the market is determined to show me my place! Also bear in mind that we can never be sure where an extension will finish!

Here are the internal waves of Hindalco’s third wave to support my hypothesis.

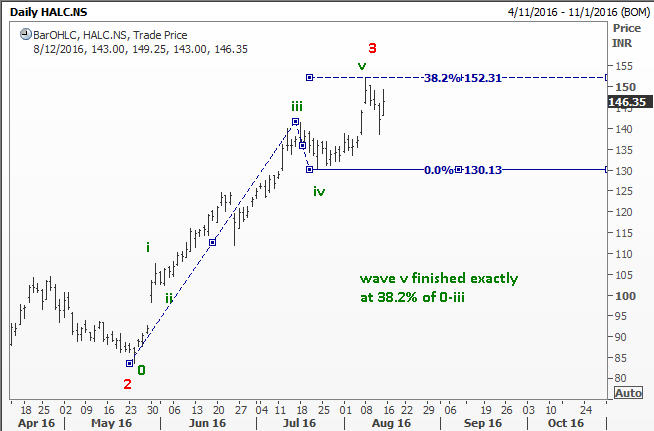

Finding out Hindalco’s minor fifth wave target

As you know from FWTFF book, you can anticipate where the fifth wave will finish by measuring the distance from point 0 to point 3, and then computing some Fibonacci ratios of that. Here you can see that Hindalco’s minor fifth wave finished exactly at the 38.2% measure of 0-3. Not bad at all!

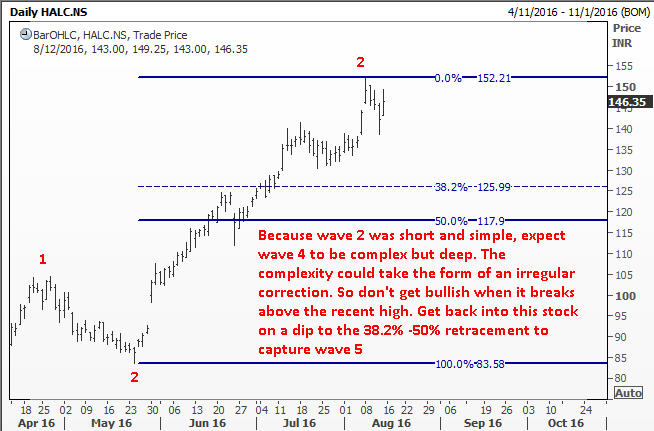

Using the guideline of alternation to your advantage

One of the advantages of learning Elliott Waves is you can anticipate the level of difficulty in an upcoming move by looking at what happened earlier. Since Wave 2 was a simple correction, we should expect wave 4 to be complex. This is as per the guideline of alternation. You will see this explained well in FWTFF book. The key point with respect to Hindalco is we should be patient now for a proper dip to at least the 38.2% levels. While we are waiting, there could be a brief period of a price over throw to around 155.50. Let that pass! If you are like me, you will rather miss a move than trying to chase a rally that is potentially near its end. This is different from jumping on to a running train as it is leaving the station.That analogy is for joining a wave 3 in its early stages.

How high can Hindalco’s fifth wave go?

Well, once you have purchased Hindalco on a wave 4 dip, you can do some calculations yourself. This calculation is no different from what you did earlier for the minor wave 5 of the third wave! But because wave 3 was extended, there is also a chance that wave 5 could become equal to wave 1. These are all explained in FWTFF book in detail. So maybe you should give it another read! Enjoy.

Would you like the opportunity to learn from one of the best teachers of Elliott Waves? Then check out my online program at https://elliottwaves.com. That course will take your trading to a completely different level. Don’t take my word for it! Check out the testimonials!