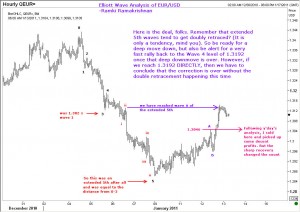

For those who actually TRADE using Elliott Wave Analysis, my recent updates on the EUR/USD would be an invaluable guide on its real time application. ( Just to let you know, I actually put money on my recommendations on FX). You will remember that I was anticipating an extended 5th wave and put in a buy order that got stopped. THen I changed the count and said we probably finished an extending 3rd wave. At that time I suggested that we will recover to around 1.3030/45 and come down to finish the 5th. (My sell order at 1.3047 was not filled, but I managed to sell at 1.3043 and 1.3028 and collected at 1.2974). Now here is the interesting bit. The Euro tested 1.2960 level two or three times and it didnt break. When it started moving up rather quickly, it was an early warning. Once it moved above 1.3008, there was no question that things are going wrong. So there is a need to take another look at the charts for the NEXT trade! Note this important point. It really does not matter whether my previous count was right or wrong. What matters is I was able to take low risk trades and ended up making money. Sure I have changed my wave count, but who told the market that Ramki’s wave count must be obeyed? These wave counts are my tools of trade, and so long as it gives me a framework to base my market orders, then it is fine. I hope you will remember these comments and adapt your trading style accordingly. Every trade needs a stop. Every wave count is just that – a count. Best wishes to all!

For those who actually TRADE using Elliott Wave Analysis, my recent updates on the EUR/USD would be an invaluable guide on its real time application. ( Just to let you know, I actually put money on my recommendations on FX). You will remember that I was anticipating an extended 5th wave and put in a buy order that got stopped. THen I changed the count and said we probably finished an extending 3rd wave. At that time I suggested that we will recover to around 1.3030/45 and come down to finish the 5th. (My sell order at 1.3047 was not filled, but I managed to sell at 1.3043 and 1.3028 and collected at 1.2974). Now here is the interesting bit. The Euro tested 1.2960 level two or three times and it didnt break. When it started moving up rather quickly, it was an early warning. Once it moved above 1.3008, there was no question that things are going wrong. So there is a need to take another look at the charts for the NEXT trade! Note this important point. It really does not matter whether my previous count was right or wrong. What matters is I was able to take low risk trades and ended up making money. Sure I have changed my wave count, but who told the market that Ramki’s wave count must be obeyed? These wave counts are my tools of trade, and so long as it gives me a framework to base my market orders, then it is fine. I hope you will remember these comments and adapt your trading style accordingly. Every trade needs a stop. Every wave count is just that – a count. Best wishes to all!

How to trade EUR/USD using elliott wave analysis

Unleash your Potential

Transform your trading – Starting Today