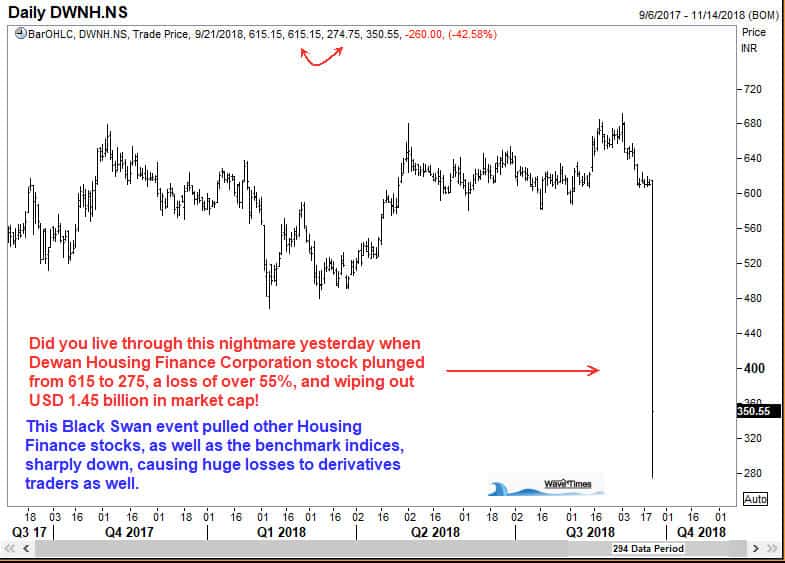

Friday 20 September 2018 will not be easily forgotten by investors in Dewan Housing Corp (DHFL) stock. This was the day when, seemingly out of the blue, news emerged of some holders liquidating commercial paper of DHFL for raising liquidity. Rumors swirled the market and pretty soon, everyone was dumping the shares of DHFL. In a matter of a couple of hours, $1.45 billion of market cap was wiped out just in this stock, and the bench mark indices experienced losses not seen in a single day since February. Could we have anticipated at least some of this? Even a warning that we should NOT be long this stock would have helped, right? Enter Elliott Waves.

Just FOUR days earlier, a client of WaveTimes Management had approached me for consultation on this very stock. I am sharing that with you, readers, to demonstrate how Elliott Waves warned us of the impending fall. This blog exists to share my knowledge with the world, and is often considered a living book, an extension of the concepts explained in my Elliott Wave book “Five Waves to Financial Freedom“. That book sells for under $10 on Amazon, and clients from around the world approach for personalized consultation using this link: https://wavetimes.net/consulting

We start with the price chart of Dewan Housing Finance Corporation at the end of Friday.

Next I will share some of the headlines that flashed on my Thomson Reuters screen.

And finally, the link to the file that I had sent to my consulting client. You will see that I warned we should not invest in this stock until a minimum down move of 20% happened. Note the word minimum. And here we are, in one swift down move that took off over 50% from this stock’s value. That is the edge we have, the power of Elliott Waves.

Here is the link for that file: DHLF

-Ramki Ramakrishnan