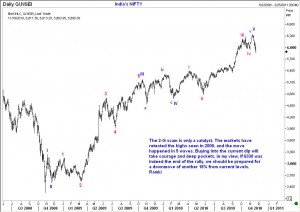

How conveniently the 2-G scam has boiled over just when the NIFTY index has come within a handshake of the 2008 highs! But if you go back in time and look at all major events, you will find that technicals were also just about ripe for a turn in direction. The attached chart shows that a 5 wave pattern has probably finished at 6338. If we get any recovery in the coming days, you should watch the speed of that recovery. Anything less than spectacular will mean that we will likely be headed lower in the next seveal weeks/months, and hence you might wish to take profits from a significant portfion of your portfolio.

How conveniently the 2-G scam has boiled over just when the NIFTY index has come within a handshake of the 2008 highs! But if you go back in time and look at all major events, you will find that technicals were also just about ripe for a turn in direction. The attached chart shows that a 5 wave pattern has probably finished at 6338. If we get any recovery in the coming days, you should watch the speed of that recovery. Anything less than spectacular will mean that we will likely be headed lower in the next seveal weeks/months, and hence you might wish to take profits from a significant portfion of your portfolio.

Has India’s NIFTY topped out?

Unleash your Potential

Transform your trading – Starting Today