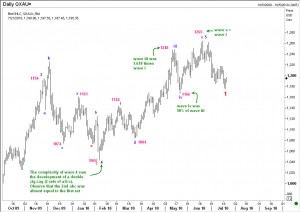

Elliott Wave analysis of Gold as discussed here on 23 December 2009 had warned us to look for one final upmove once the complex correction from the prior peak at 1226 was completed. We got the move that reached 1265 on 21st June 2010. I would now like to suggest that Gold has probably completed a major 5-wave rally off the low at 252 posted in July 1999. That means we should plan for a decline of minimum $350, and the correction will last at least 14 months. However, the time to sell is not here, because we are just about finishing the first leg of the decline. Wait for a decent pull back, (at least 50% of the move down from 1265) and then join in the selling as it starts going down. It is of course possible to figure out more precise sell levels, but that will entail monitoring the intra-day charts regularly, something I am not able to do presently.

Elliott Wave analysis of Gold as discussed here on 23 December 2009 had warned us to look for one final upmove once the complex correction from the prior peak at 1226 was completed. We got the move that reached 1265 on 21st June 2010. I would now like to suggest that Gold has probably completed a major 5-wave rally off the low at 252 posted in July 1999. That means we should plan for a decline of minimum $350, and the correction will last at least 14 months. However, the time to sell is not here, because we are just about finishing the first leg of the decline. Wait for a decent pull back, (at least 50% of the move down from 1265) and then join in the selling as it starts going down. It is of course possible to figure out more precise sell levels, but that will entail monitoring the intra-day charts regularly, something I am not able to do presently.

Enjoy. Ramki