My last Elliott Wave analysis of EUR/USD was posted on 24th May. When dealing with the bigger picture, I find it generally useful to leave the markets to sort out the minor squiggles by itself. For the corporate treasurer and hedge fund manager as well as other medium term players, the bigger direction is more relevant. Also, my approach to Elliott Wave Analysis is to use it as a road map for trading. It is not going to give us buy or sell signals all the time. In any case, those decisions are to be made by the trader. Knowing the pressure points will enable us make better trading decisions, and Elliott wave analysis gives us that advantage. In today’s post, where I have looked again at EUR/USD, I am defining some likely turning points for the Euro, and am suggesting it will come off towards 1.2480. For the record, if EUR/USD breaks 1.3285 on a closing basis, the whole count will change and we will probably be looking at 1.3690. As of now, we have a strategy. How we implement that will depend on what happens at the pressure points. There is no need to catch the very top of a move to be profitable. Good luck. Ramki

My last Elliott Wave analysis of EUR/USD was posted on 24th May. When dealing with the bigger picture, I find it generally useful to leave the markets to sort out the minor squiggles by itself. For the corporate treasurer and hedge fund manager as well as other medium term players, the bigger direction is more relevant. Also, my approach to Elliott Wave Analysis is to use it as a road map for trading. It is not going to give us buy or sell signals all the time. In any case, those decisions are to be made by the trader. Knowing the pressure points will enable us make better trading decisions, and Elliott wave analysis gives us that advantage. In today’s post, where I have looked again at EUR/USD, I am defining some likely turning points for the Euro, and am suggesting it will come off towards 1.2480. For the record, if EUR/USD breaks 1.3285 on a closing basis, the whole count will change and we will probably be looking at 1.3690. As of now, we have a strategy. How we implement that will depend on what happens at the pressure points. There is no need to catch the very top of a move to be profitable. Good luck. Ramki

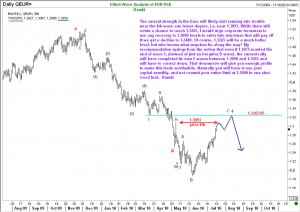

EUR/USD Elliott Wave Analysis 18 July 2010

Unleash your Potential

Transform your trading – Starting Today