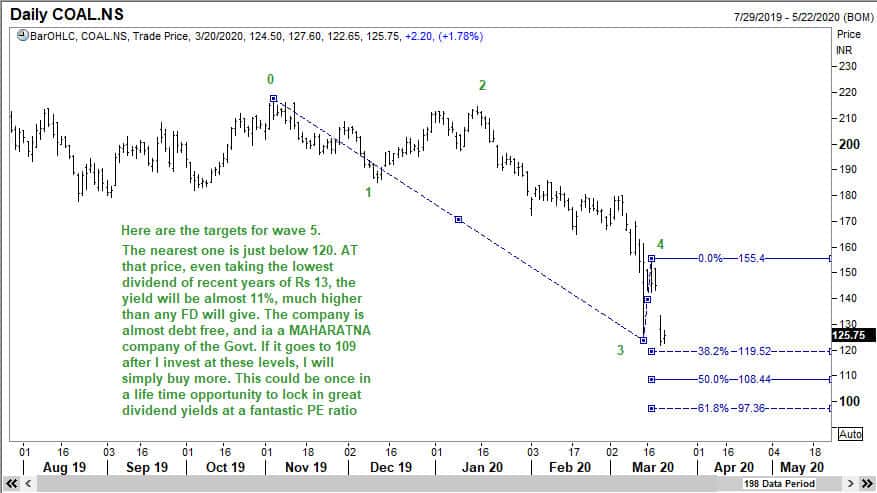

I am going to keep this post short, because the key points appear in the one chart that I am sharing with you. Trading and investing is all about timing and making smart decisions. Elliott Waves helps you decide on a low-risk entry point, something that I have discussed in my book, and reinforced with examples in my online program. But the selection of the instrument also plays a role in mitigating one’s risks. If you choose a highly volatile stock, then you should also be extremely disciplined to cut and run at the first sign of trouble. In the example shown below, we had a happy confluence of both the end of a wave 5, and one of the top 30 stocks in India by way of market capitalization. To add flavor to the cream, the dividend yield at our entry point made it a compelling buy. You can see how WaveTimes adds value, whether you are simply happy to learn from these examples, or, if you are an experienced trader of size and a member of the exclusive club of WaveTimes.

The stock that we invested in was Coal India.

The stock made a low of 119.20 on 26 March 2020, and today, 31 March 2020, it has traded at a high of 137.80.

My online program at https://elliottwaves.com gives an insight into how I approach the market using Elliott Waves.