Elliott Wave Theory

Elliott Wave Theory is quite straightforward. Created by Ralph Nelson Elliott and first published in his book “The Wave Principle” in 1938, this theory has suffered numerous misinterpretations at the hands of careless analysts. It is true that Ralph Elliott was not an expert copywriter, and he tried to present a more comprehensive version in his final work “Nature’s Laws: The Secret of the Universe” in 1946. However, a diligent student can learn quite a lot by paying attention to not just the main features of the Elliott Wave Theory, but also to the numerous clues that are strewn in all of Ralph Elliott’s works. In this article, I will try and summarize some of the main points of the Wave Theory. Also explained are Elliott Wave Cycle, the three key Elliott Wave Rules that are considered the pillars of the Wave Principle, and the Personality of some waves such as the third wave in a cycle.

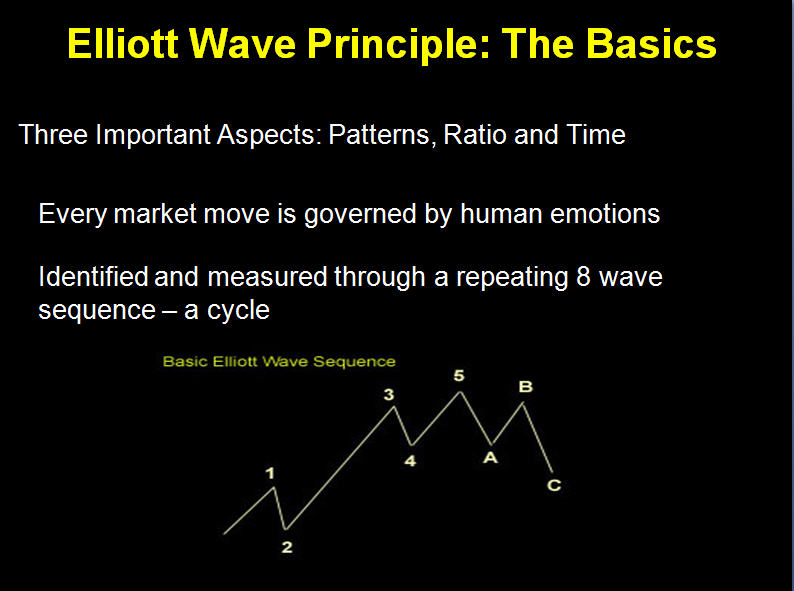

The Elliott Wave Cycle

Ralph Elliott found that in an uptrend, or a bull phase of the market, prices went up in five waves. Three of these waves were in the upward direction, and he called these waves ‘impulse waves’. Each of the three waves was followed by a downward movement, which he called a ‘corrective wave’. Here is a clue that is not often very clear! Whereas the first and second impulse waves were followed by a smallish correction, the downward move that came after the fifth wave up was a larger move. This was so because this last mentioned downward move corrected not just the preceding impulse wave (the 5th wave) but also the entire five wave sequence.

So to recap, in a bull market, we will see three upward moves and two downward moves. Once the five waves are completed, we will get a correction that will be bigger than the two previous corrections because this downward move corrects not just the fifth wave, but the entire set of five waves up.

If a sequence of five waves plus three waves is completed as above from a significant low, then the completed cycle will represent the first and second waves of a cycle in the time frame of the nest higher degree. Every impulse wave is actually made up of a five-wave sequence within itself. Corrective waves are usually made up of three waves, or combinations of three-wave sequences.

Elliott Wave Rules

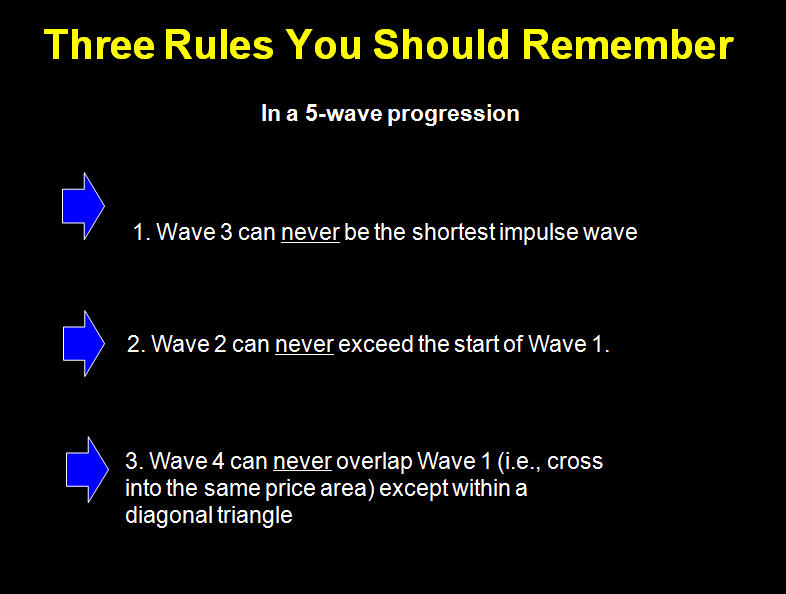

The Elliott Wave Principle has just three straight forward rules. In a five wave progression,

- Wave 2 can never exceed the start of wave 1

- Wave 3 can never be the shortest impulse wave

- Wave 4 can never overlap wave 1 (i.e. cross into the same price area) expect within a diagonal triangle.

Easy enough, right? The trouble is to understand how to use these rules to your advantage. In my book “Five Waves to Financial Freedom” I have explained all these with numerous examples. But you could see hundreds of charts in this blog itself. At Wavetimes.com, there are Elliott Wave examples covering dozens of asset classes. For instance, here is a EURUSD example of Elliott Wave analysis.

Wave Personality

In addition to giving us the rules of Elliott Wave Theory, Ralph Elliott also discussed the personality of the waves at various positions in the cycle. For example, the third wave is usually the steepest wave, and is accompanied by expanding volume. A corrective wave in the fourth wave position is usually complex in nature. You will see sudden departures from normative behavior. Also, just when you think a correction is almost finished, a complex fourth wave will add another level of complexity to the formation. These are just some examples of wave personality.

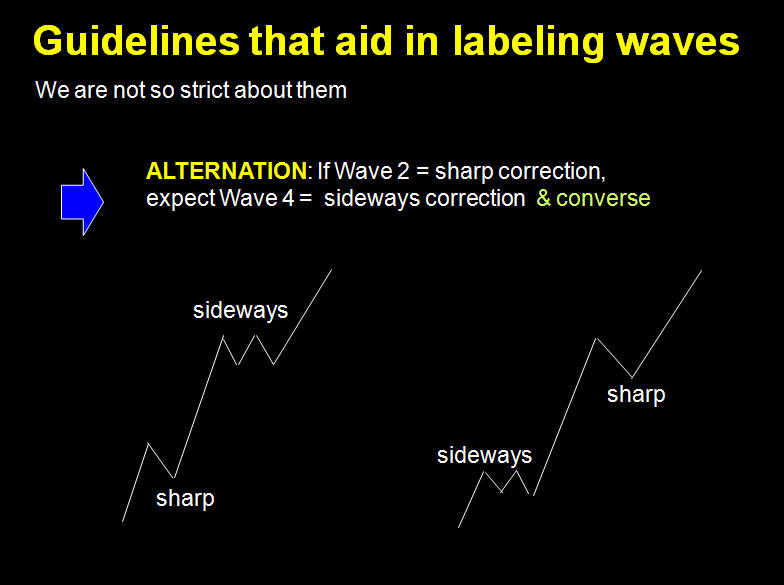

Alternation between waves

Another feature of Elliott Waves is the tendency of waves to alternate between long and short, between simple and complex, between the length s of time that alternating waves spend etc. For example, if wave 2 was a simple correction, you should expect wave 4 to be complex. These are valuable clues to the trade that can offer a real edge in the market, the so-called Elliott Wave Edge.

Fibonacci Ratios in Elliott Waves

Any explanation of Elliott Wave Theory, however brief, will be incomplete without a mention of the use of Fibonacci Ratios. These ratios are computed from the Fibonacci number series that start of like this 1,1,2,3,5,8,13,21…. As you can see, each number is the sum of the preceding two numbers. Fibonacci Ratios are computed from these numbers. The key ratios used in Elliott Wave Analysis are 38.2%, 50%,61.8%, 100%, 138.2% and 161.8%

Generally speaking, the following relationships work.

- Wave 1 is corrected by wave 2 by between 50% to 100% (note that 50% is obtained by dividing 1 by 2 in the Fibonacci series of numbers)

- Wave 3 is usually 161.8% of wave 1

- Wave 4 is often 38.2% of wave 3. Occasionally, when wave 1 was a shallow correction, we can see wave 4 coming down by 50% of wave 3, and very rarely 61.8% of wave 3. If wave 3 was an extension, then wave 4 is more likely to terminate around the 23.6% retracement level.

- Wave 5 is often computed by taking either a 38.2% measure or a 61.8% measure of the distance traveled from the start of wave 1 to the end of wave 3. If Wave 3 had extended, then there is a high chance for wave 5 to be equal to wave 1.

- Within corrections, in a zigzag correction, wave C is often 161.8% of wave A. If the correction is a flat correction, then wave C is usually equal to wave A or no more than 138.2% of wave A.

You can read more about the Fibonacci Number Series here.

Corrective Waves

Most traders encounter difficulties when dealing with corrective waves. Elliott Wave theory has broadly classified corrections as Zigzags, Flats and Triangles.

A zigzag correction often corrects the previous impulse wave by a significant extent. A zigzag correction is made up of two sets of mini-impulse waves separated by a corrective wave. Thus the sub-waves of a zigzag correction tend to be 5-3-5 waves sequence.

A flat correction, on the other hand, will only correct a smaller portion of the previous impulse wave. Furthermore, the sub waves of the flat correction will be made up of a 3-3-5 sequence. Notice that in the zigzag as well as flat correction, the last sub wave is a five wave affair!

Triangles are further classified as horizontal triangles and leading or ending triangles. The sub-waves of these triangles have their own personality traits. If it is a leading diagonal triangle, the sub waves are made up of 5-3-5-3-5 waves. But if it is an ending diagonal triangle, the sub waves are 3-3-3-3-3 waves.

Don’t be alarmed, but sometimes corrections tend to become complex whereby we see combinations of zigzags, flats or triangles. This is why I always advise traders to avoid trading complex corrections. You can identify a complex correction using the tendency of waves to alternate in complexity. Occasionally wave 2 becomes a complex wave, in which case your stop loss is anyway supposed to be placed below the start of the wave 1!

The Elliott Wave Edge

When a trade uses Elliott Wave Analysis to determine where we are in the big picture, and then computes likely levels where a turn is highly probable, then he/she has what I would like to call the Elliott Wave Edge. Once he uses all the rules, his knowledge of the personality of the waves, and the price targets using Fibonacci Ratios, the trader will be able to determine a price level where he could initiate a position in the market place. After that, it all boils down to money management. The determination of a low-risk entry level is the key benefit of doing Elliott Wave Analysis. A trader who has the Elliott Wave edge will find that the consistent application of the Elliott Wave analysis to his trading activity will produce a series of winning trades that will make him money over time. You can read more about the Elliott Wave Edge here.

Elliott Wave Resources

Your main Elliott Wave resource should be this blog because it offers hundreds of real-time Elliott Wave examples from a variety of financial markets around the world. Your goal is to gain a sound understanding of the Wave Principle before you apply it yourself. A good introduction to Elliott Wave Analysis is my own ebook, Five Waves to Financial Freedom. You might want to read some of the reviews first. And finally, if you want to learn How to Profit from Elliott Waves, you should conisder enrolling in my online Elliott Waves Course. That will transform teh way you trade, forever.

I wish you the best of luck in your search for investment and trading success.