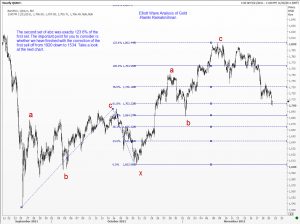

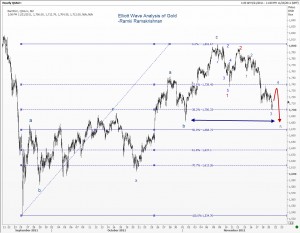

Elliott wave analysis of Gold suggests that the recovery from 1534 to 1803 has fulfilled at least one part of the required correction. When we last considered this commodity back in September 2011, we were suggesting that it made sense to consider going long from 1575, because there was a strong support at 1478. We also said that strong resistance was expected at 1790. The metal stopped abruptly at 1534 and embarked on the correction that failed at 1803. So we pretty much anticipated most of the movement that has taken place in the last two months. ( To come up with this analysis, I used the same techniques that you have read in the book, “Five Waves to Financial Freedom”)

Elliott wave analysis of Gold suggests that the recovery from 1534 to 1803 has fulfilled at least one part of the required correction. When we last considered this commodity back in September 2011, we were suggesting that it made sense to consider going long from 1575, because there was a strong support at 1478. We also said that strong resistance was expected at 1790. The metal stopped abruptly at 1534 and embarked on the correction that failed at 1803. So we pretty much anticipated most of the movement that has taken place in the last two months. ( To come up with this analysis, I used the same techniques that you have read in the book, “Five Waves to Financial Freedom”)

Looking at the picture now, I think we might get a smallish recovery towards 1725, but there is a good chance for a move lower towards 1662. HOwever, I will be quite happy to cover shorts sligtly higher at the 1680/85 levels. We will take up the question of whether we will get a new rally higher after we see the dip that we are hoping will happen. ( I have given you a clue here, let us now see whether you can discuss that in the forum with others!) Enjoy.

Elliott Wave update on Gold 21 Nov 2011

Unleash your Potential

Transform your trading – Starting Today