First question. What on earth is this instrument? The ZSL Ultra Short Silver is an ETF described by Reuters as…”The Fund seeks to provide daily investment results (before fees and expenses) that correspond to twice (200%) the inverse (opposite) of the daily performance of the corresponding benchmark”

First question. What on earth is this instrument? The ZSL Ultra Short Silver is an ETF described by Reuters as…”The Fund seeks to provide daily investment results (before fees and expenses) that correspond to twice (200%) the inverse (opposite) of the daily performance of the corresponding benchmark”

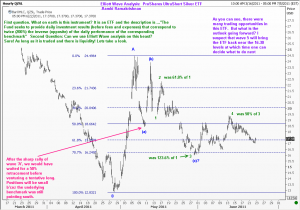

Second Question: Can we use Elliott Wave analysis on this beast?

Sure! As long as it is traded and there is liquidity! Lets take a look.

For those of you who are not into ETFs, this exercise is still a learning experience. For Fund Managers who are exposed to this ETF, well, here is a neat exposition of how Elliott Wave Analysis works in your sphere just as well as it does elsewhere. Enjoy.