I will post you a couple of charts that I prepared for my old friend Bob D (remember the person who gave me so much of his valuable time in proof reading your favorite book, Five Waves to Financial Freedom?)

With Elliott Waves, you should never struggle to count the waves. When it becomes hard, just step back and look at the bigger picture. The best trades are done when you are able to see the waves easily and clearly, while the rest of the world is stressing out about the next few points. You, on the other hand, having read and understood my way of approaching the market, would place your bids or offers near the anticipated targets and wait for the fruit to land on your lap! Of course, occasionally you will get a lemon, but often enough it will be a sweet fruit.

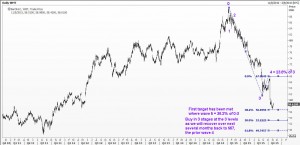

Here are the Elliott Wave charts of WalMart. The second chart shows the third wave in detail. As I point out, you really don’t need to go very deep! Just keep it simple. All the best.