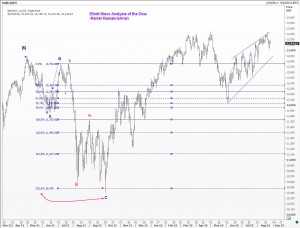

After my recent posts on the S&P500 provoked some animated discussions, I was persuaded by one reader to look at the Dow. What follows below are three charts that offer my Elliott Wave Analysis of the Dow Jones Industrial Average.

Elliott Wave Rules and Guidelines continue to be observed here. However, I must confess that I am trying to squeeze in a count to fit my view. This is not an entirely recommended approach to using the wave analysis. However,because I am not able to honestly call the current recovery from the June low of 12035 as impulsive, the wave counts that I offer you on the Dow here is my best effort. We shall know soon enough. Good luck folks.