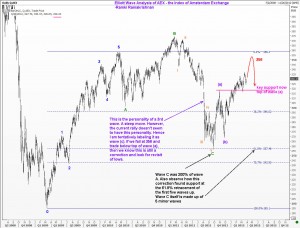

As part of your Elliott Wave education, WaveTimes brings you the analysis of the AEX Index, which is a free-floated adjusted market capitalization weighted index of the leading Dutch (Netherland) stocks on the Amsterdam Exchange.

As always, there are notes directly on the chart itself. Elliott Wave analysis is always a work in progress. You should not ever think that once you do your wave counts, you can forget about it and the markets have to obey your diktat! Quite the opposite, really! The market is the master, and we make adjustments along the way. However, the real value of Elliott Waves come into play when you know before hand that there is a chance to reach 356, and that if the index starts coming off from there, we should be watchful near the top of wave (a) because a move below that top will violate one of the rules of Elliott Wave Principle. If that happens, we will cease to buy dips because we will then be back in a bear mode…and so on and so forth.

Of course, Elliott Waves will appear daunting to the uninitiated, but I hope the book “Five Waves to Financial Freedom” has helped make it easy for you to learn enough of Elliott Waves so that you can start applying what you have learned quite quickly. Good luck, ye punters.