As many of you are aware, I offer a consulting service at WaveTimes.net. Occasionally I share some of those cases with you to help you learn Elliott Wave analysis. The following is a consultation I did with a trader based in Singapore who wanted to discuss the outlook for USDSGD. Please note that wave counts are always a work-in-progress. While it worked out as anticipated at that time (the analysis was done on October 14, 2015 when USDSGD was trading around 1.3870) the outcome from the current levels needs a fresh look.

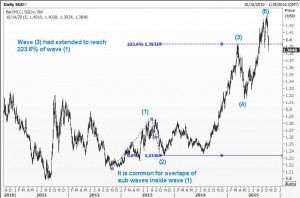

Establishing the broad big picture in USDSGD from an Elliott Wave stance

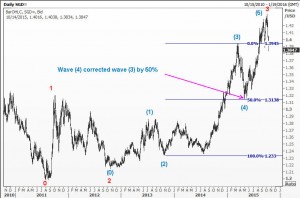

Figuring out weaknesses, if any, in initial analysis

Considering alternative wave counts and deciding which is appropriate

Using Fibonacci Ratio Analysis to validate our wave counts

Seeing if we are consistent in our approach

Fifth Wave target using methods taught in Five Waves to Financial Freedom – Elliott Wave book

Illustrating how each impulse wave is made up of five sub waves

Showcasing the ‘fit’ of the waves in the bigger picture – Elliott Wave structure

Fibonacci Ratio Relationships work even within sub waves!

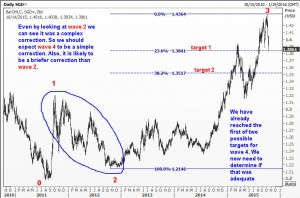

Elliott’s principle of alternation

Detailing the finer aspects in intra-day Elliott Wave charts

Anticipating ending points of USDSGD in the near term

Formulating a recommendation considering potential moves

In case you are wondering how it turned out, well here is a screen shot as of today, with the key turning points after 14 Oct marked out for you.

Elliott Waves do work in USDSGD as can be seen here

I hope you enjoyed the learning experience in this post. It will be great to see this shared with your friends in the market place. Best wishes, Ramki