My detailed Elliott Wave analysis of Silver was posted via a video on You Tube on 8th October. That analysis is typical of how a general update in this blog appears. The aim is to teach people how to approach the market. The same goes for my comments on Forbes, MarketWtach or Seeking Alpha. Those comments are meant to give a general sense of direction. Occasionally, I might slip in a key level, but the trader would need the comfort of knowing whether the timing is right as the market approaches the anticipated levels. Take my Silver comments of last week, for example. I anticipated that we will come down to 33.16 when the commodity was trading around 34.45. Was 33.15 a good level to buy? It was not, because by the time it reached there, the market had revealed additional clues. A ‘relatively’ safe level to buy was lower down at 32.55, something which I was able to determine by the analysis produced here.

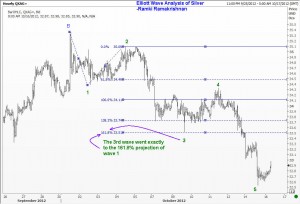

When it was clear that we are getting an extended fifth wave within the C wave of the fourth, I knew that the support was not at the 23.6% retracement level discussed in the video. A quick computation revealed that each of the sub waves within the C wave was respecting all the tenets of Elliott Wave Principle – details that you would have learned by reading “Five Waves to Financial Freedom”. For example, wave 2 was 70.7% of wave 1 as shown in the first chart to the right.

When it was clear that we are getting an extended fifth wave within the C wave of the fourth, I knew that the support was not at the 23.6% retracement level discussed in the video. A quick computation revealed that each of the sub waves within the C wave was respecting all the tenets of Elliott Wave Principle – details that you would have learned by reading “Five Waves to Financial Freedom”. For example, wave 2 was 70.7% of wave 1 as shown in the first chart to the right.

Wave 3 of the C wave traveled exactly 161.8% of the first wave.

Wave 3 of the C wave traveled exactly 161.8% of the first wave.

The fourth wave recovered to the 50% retracement level of the third wave.

The fourth wave recovered to the 50% retracement level of the third wave.

I figured out the target for the extended fifth before it got there by projecting a 100% measure as shown in the next chart. And I obtained added confirmation by analyzing the internal waves of the fifth wave of the extended fifth wave as shown in the final chart.

I figured out the target for the extended fifth before it got there by projecting a 100% measure as shown in the next chart. And I obtained added confirmation by analyzing the internal waves of the fifth wave of the extended fifth wave as shown in the final chart. At the time of writing this post, Silver has already reached 33.20. I received a few emails from readers that they have gone long of silver around 33.15 based on my video! First of all, please bear in mind that Wave Times is only there to teach. Secondly, we have to take into account new information as it comes up. And the nature of Elliott Waves is such that it is very dynamic, and allows us to adjust our focus as the subject is moving. When I launch my exclusive program for the high net worth traders, they will get more precise information, including a recommended stop level. I will also be able to recognize early if something is going wrong and share that intelligence with the group. However, the key take away for you is this. Learn my techniques, and you can do the analysis yourself. You don’t need any Guru to tell you what to do! More importantly, don’t risk real money on an update that is 2 or 3 days old, especially if you are a risk-averse trader who can afford only a small loss. Good luck! P.S. If you recall my various comments on how Extended Fifth Waves can make you rich, you will also know that sometimes we get a double retracement! But at other times we don’t! Watch Silver and learn! You should also learn where to take partial profits, how to adjust your stop loss etc etc! All the best

At the time of writing this post, Silver has already reached 33.20. I received a few emails from readers that they have gone long of silver around 33.15 based on my video! First of all, please bear in mind that Wave Times is only there to teach. Secondly, we have to take into account new information as it comes up. And the nature of Elliott Waves is such that it is very dynamic, and allows us to adjust our focus as the subject is moving. When I launch my exclusive program for the high net worth traders, they will get more precise information, including a recommended stop level. I will also be able to recognize early if something is going wrong and share that intelligence with the group. However, the key take away for you is this. Learn my techniques, and you can do the analysis yourself. You don’t need any Guru to tell you what to do! More importantly, don’t risk real money on an update that is 2 or 3 days old, especially if you are a risk-averse trader who can afford only a small loss. Good luck! P.S. If you recall my various comments on how Extended Fifth Waves can make you rich, you will also know that sometimes we get a double retracement! But at other times we don’t! Watch Silver and learn! You should also learn where to take partial profits, how to adjust your stop loss etc etc! All the best

Elliott Wave Analysis of Silver – update

Unleash your Potential

Transform your trading – Starting Today