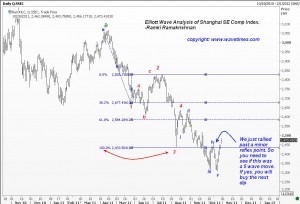

It is three months since I presented some Elliott Wave Analysis of the Shanghai SE Composite Index.. There are several requests for an update and so here are the relevant charts with Elliott Wave comments.

It is three months since I presented some Elliott Wave Analysis of the Shanghai SE Composite Index.. There are several requests for an update and so here are the relevant charts with Elliott Wave comments.

You should compare the first chart with my last update of July 18th. The wave counts are completely different, but we got the direction correct. What was the deciding factor for my bearishnes at that time? It was the personality of the move from the red colored C. Remember that you DON’T have to be worried about your wave count to make money. The count is never a fixed thing. Just follow the rules and guidelines governing the theory (and if you wish, the many tips in my book, Five Waves to Financial Freedom, and you should be able to trade with confidence