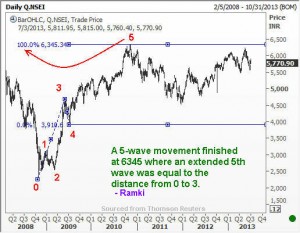

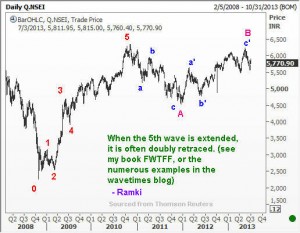

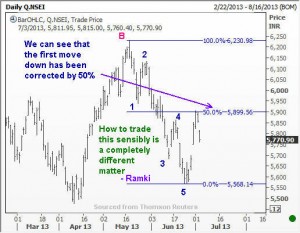

Hello Traders from India. I know you have all been patiently waiting for some indication about your famous NIFTY index. This post will attempt to give you an idea of my current thinking. As you all know, I am not offering any trading advice on this blog. Members of the exclusive club get to see how I would actually trade using Elliott Waves. However, there is enough material here for you to do your own thinking. Good luck!

Elliott Wave Analysis of Nifty

Unleash your Potential

Transform your trading – Starting Today