Elliott Wave Analysis of Home Depot shows some interesting possibilities. I recollected having posted on Home Depot some time ago, and looked it up. I suggest that you do the same, as it is a learning experience. That old post which appeared on Forbes did not work out as anticipated. The dip was shallow and the stock started climbing again. What did we learn from that? (a) There are no guarantees in the market (b) We should always have a stop (c) We should be willing to turn around and do the opposite if the wave count shows an extension is in progress. However, these are easier said than done. In spite of these difficuties, I can confidently say that few other approaches to the market gives as good results as Elliott Waves. Hence, we should take such adversity in our stride, and profit from those instances where it works.

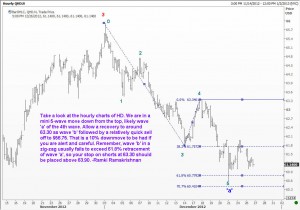

Today I am presenting you with several Elliott Wave charts of Home Depot. There are comments on each of them, explaining my wave counts. Study them and see how I am arriving at my conclusions. An easy way to read them quickly is to open each chart in a new tab and then look at them one by one. As always, WaveTimes is a place where you come to learn Elliott Wave analysis. Good luck.