The global stock market is so vast that the more eyes there are to spot the approaching end of a five-wave pattern, the better off we are! I should thank Bob D for drawing my attention to Freeport-McMoran Inc (FCX) -NYSE. The following discussion covers the Elliott Wave analysis of this stock. You will see how the various twists and turns in FCX were all following the dictates of the Elliott Wave Principle.

When we commence the analysis of any instrument, it is always better to start with the bigger picture. So we commence our study with the weekly chart of FReeport-McMorRan Inc.You got to remember that the goal of any analysis is to provide you with a framework to base your investment or trade. Such a framework will give you an orderly way to approach the market. It doesn’t guarantee you profits, but you will know quite early whether you are on the right track or not, and that knowledge alone is well worth the time you invest in this process. So lets get started with our first Elliott Wave chart. I suggest that you keep opening each chart in a new tab to save you time.

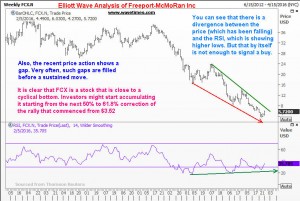

On 20 January 2016, FCX made a low of $3.52. We see from the chart below that a complex correction has developed from the high near $61, probably unfolding as a double zigzag. The end of the second zigzag was projected to land at a 138.2% projection just a shade above the $4 mark. Perhaps the 3.52 low marked the end of this major correction?

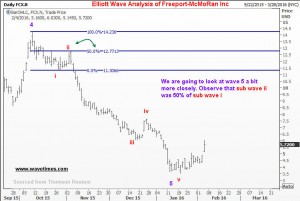

Now let us quickly go down to the more recent moves. Notice the green arrow in the chart above? I suggest we start our next wave count from there, as it looks like a pivot point.Two things stand out clearly. We can make out a set of five waves from near the $24, and to our delight, there is a further set of 5 minor waves inside the fifth wave that is quite clear.

In order to give us more comfort that about this fifth wave, we will delve deeper to see if the waves hold some Fibonacci ratio relationship to each other. The chart below shows that sub wave ii corrected the sub wave i by 50%

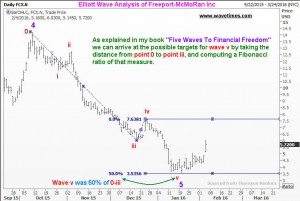

Next we see that the sub wave iii was extended. An extension is when an impulse wave travels more than 161.8% (Note: this is my own interpretation of when to label a wave as extended). In this case, sub wave iii went as far as 223.6% of wave i.

You might remember from your reading of my book ‘Five Waves to Financial Freedom” that when a third wave is extended, it is normal for the fourth wave to be short and typically correct to just 23.6% of the just completed third wave. You can see from the Elliott wave chart of Freeport-McMoRan Inc below that sub wave iv went exactly to the 23.6% retracement target. This sort of reinforces the feeling that we are on the right track!

And finally, we see that the fifth wave was exactly 50% of the distance from the point ‘0’ or the starting point of subwave i to the terminal point of subwave iii. This is again quite text-book-like, and is something to be looked at in wonderment!

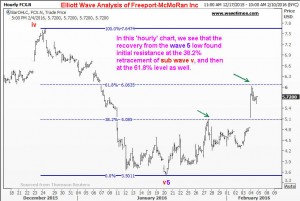

I leave you with two more charts for careful consideration. My Elliott Wave comments are on the charts themselves. Remember, this blog aims to teach you some of my methods. I am not making a recommendation here. But if you are patient, and if you can identify 5 waves up from the bottom, then buying into a 50% to 61.8% pull back is a most logical thing to do, especially if you are a believer that Elliot Wave Principle works! In case you are not convinced, simply look at the hundreds of other examples in this blog! All the best.