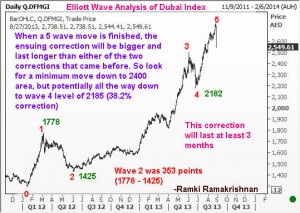

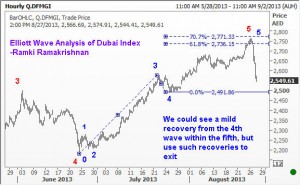

Hello Traders from the Middle East. So Dubai Stock index, or the DFM Index, has collapsed today, losing over 7%. Shocking, but the writing was on the wall all along. With the increase in rhetoric about Syria, we just needed a small push and it would have fallen over the cliff! When a move is approaching the end of its 5th wave, any informed investor would have sold off all his shares and waited for the inevitable correction to start. Elliott Wave Analysis of Dubai Stock Index shows that the 5th wave has indeed been completed. a fact that has become evident today, but something we should have anticipated. You can observe from the Elliott Wave charts attached that Dubai index had earlier seen an extended third wave. When you already have an extension in either the first wave or third wave, you should expect the fifth wave to be of normal proportions. Finally, by examining the sub waves of the fifth wave, you could have gotten out of most of your investments close to the top. This is shown in the last chart below. What is the outlook for Dubai Index from here? Well, there are mild supports at the fourth wave level within the just completed fifth wave.But expect any recovery to be mild and short lived. We should choose to exit on a pull back, waiting for the next bull market to be signaled by Elliott Waves sometime in the future.

Elliott Wave Analysis of Dubai Stock Index

Unleash your Potential

Transform your trading – Starting Today