Elliott Wave Analysis works very nicely in commodities. There is a lot of money to be made if you can apply the techniques you learnt in Five Waves to Financial Freedom. Trouble is, even if you learn the methods, you need to have the capital and the stomach to pull the trigger at the right time, and more importantly, to stay with the trade until your sensible stops are done or your profit levels are reached. This is a challenge that ranks at par with being good at analysng the markets.

Elliott Wave Analysis works very nicely in commodities. There is a lot of money to be made if you can apply the techniques you learnt in Five Waves to Financial Freedom. Trouble is, even if you learn the methods, you need to have the capital and the stomach to pull the trigger at the right time, and more importantly, to stay with the trade until your sensible stops are done or your profit levels are reached. This is a challenge that ranks at par with being good at analysng the markets.

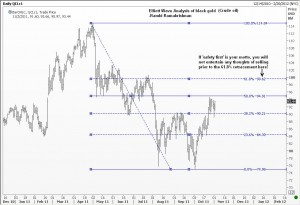

Now without any further ado, let me present you with your favorite charts! Enjoy!

By the way, I am off on an exotic holiday to Cambodia tomorrow.

Best of luck in the meantime, and if the Forum goes live, you may start sharing your thoughts and ideas with other members right away.