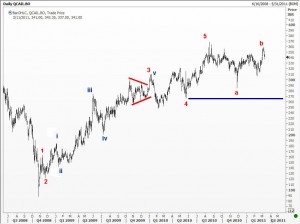

I thought I’d take a quick look at the chart of CAIRN india before shutting down for the upcoming holidays. But I ended up spending a good 30 minutes trying to decipher what was going on. At long last, I have come up with my best version and here is the bottom line. A five wave sequence is probably over, and we are just in the early stages of the C wave of teh correction. Take a look at the chart for the details.

I thought I’d take a quick look at the chart of CAIRN india before shutting down for the upcoming holidays. But I ended up spending a good 30 minutes trying to decipher what was going on. At long last, I have come up with my best version and here is the bottom line. A five wave sequence is probably over, and we are just in the early stages of the C wave of teh correction. Take a look at the chart for the details.

Elliott Wave Analysis of Cairn India

Unleash your Potential

Transform your trading – Starting Today