Hello folks, It has been a busy few weeks as I was spending all my evenings putting together my book. Almost done, now! Between, I noticed that Crude Oil came quite close to the target of $71. Remember we have been bearish on this from the time it was around 110? (when some leading investment banks were calling it to $150).

Hello folks, It has been a busy few weeks as I was spending all my evenings putting together my book. Almost done, now! Between, I noticed that Crude Oil came quite close to the target of $71. Remember we have been bearish on this from the time it was around 110? (when some leading investment banks were calling it to $150).

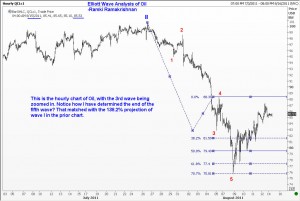

The outlook for Crude Oil in the near term is for a failure between 88.10 and 89.50 and come down once again. Hopefully, this time we will reach the target of 71 levels. Stops should be placed on two closes above 89.80 Take a look at the attached chart and stay tuned for the announcement regarding the book!