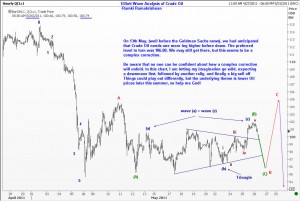

On 15th May, I prepared the first chart for a friend of mine in the Far East. The important point to note is this was done before Goldman Sachs came out with a bullish call on Oil. The set-up was right, and the moment that news hit the market, prices started going up. This is the way things usually work. There will be a catalyst, and the move will materialize! However, once the catalyst wears off, or as fresh news comes to the fore, the old fundamentals will reassert themselves. The only tool we have is Elliott Wave Principle. Our count says Oil will go lower, once this correction is finished. We should stick with the original view until the count is proved wrong (by the violation of one or more rules of the Wave Principle, or by some guideline going out of sync with the developing patterns).

On 15th May, I prepared the first chart for a friend of mine in the Far East. The important point to note is this was done before Goldman Sachs came out with a bullish call on Oil. The set-up was right, and the moment that news hit the market, prices started going up. This is the way things usually work. There will be a catalyst, and the move will materialize! However, once the catalyst wears off, or as fresh news comes to the fore, the old fundamentals will reassert themselves. The only tool we have is Elliott Wave Principle. Our count says Oil will go lower, once this correction is finished. We should stick with the original view until the count is proved wrong (by the violation of one or more rules of the Wave Principle, or by some guideline going out of sync with the developing patterns).

I have said that we are in a correction. As you can see from the scond chart, this correction is turning out to be a complex one, ie one where there are combinations of smaller patterns. Complex corrections are notoriously unpredictable because they take all shapes and travel distances that we cant anticipate. Yet, I have given one possible version here. What is more important for most traders is the bigger direction, Is it down, or is it up? I still think we go lower. Let us see.

I have said that we are in a correction. As you can see from the scond chart, this correction is turning out to be a complex one, ie one where there are combinations of smaller patterns. Complex corrections are notoriously unpredictable because they take all shapes and travel distances that we cant anticipate. Yet, I have given one possible version here. What is more important for most traders is the bigger direction, Is it down, or is it up? I still think we go lower. Let us see.