A friend asked me to look at the charts of Care Ratings Ltd as it looks interesting. A cursory glace would reveal that we have seen a deep correction in this stock, and that too in 3 waves. The question is whether it is time to invest in it for the medium term.

Elliott Waves gives us a big advantage when it comes to picking candidates as well as to choosing our entry levels. But you should know which battles to get involved in. Where is there scope for a different outcome, i.e. for continuation of the trend after a correction, you should consider the case very carefully.

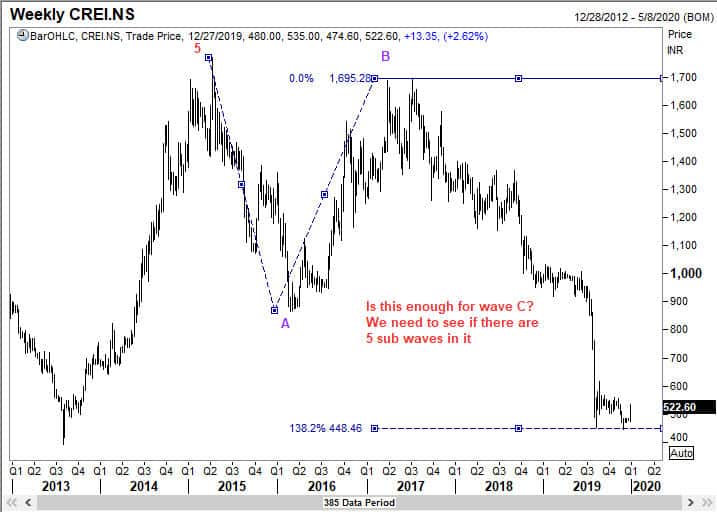

For example, in the case of Care Ratings, you can see from the following chart that wave C has reached the 138.2% projection of wave A. Can we say with confidence that this is enough of a correction?

The easiest way to answer that question is to see if we can make out 5 waves inside wave C. As explained in my book Five Waves to Financial Freedom, all C waves should be made up of 5 sub waves.

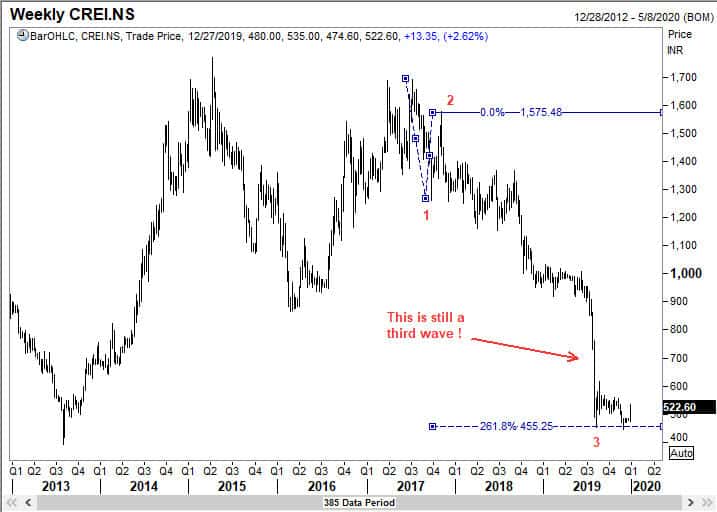

When we examine wave C in detail, we see that there is a good chance that we have only finished an extended sub wave 3 at the lows.

I have explained in great detail in my online program using multiple examples how I make some of my decisions regarding waves. But here, I am choosing 455 levels as the end of wave 3. Now let me make one thing clear. It is perfectly possible that I am wrong and the correction is already over. But when it comes to trading real money as against merely posting charts on a website, you need to choose those trades where the odds are clearly in your favor. Many people are under the impression that the price will turn merely because a certain Fibonacci target has been reached. They will find from experience that this is not how the market operates. If one can become profitable just by computing certain ratios, then we will all be multi millionaires. So knowing which battles to get involved is very crucial for your financial health.

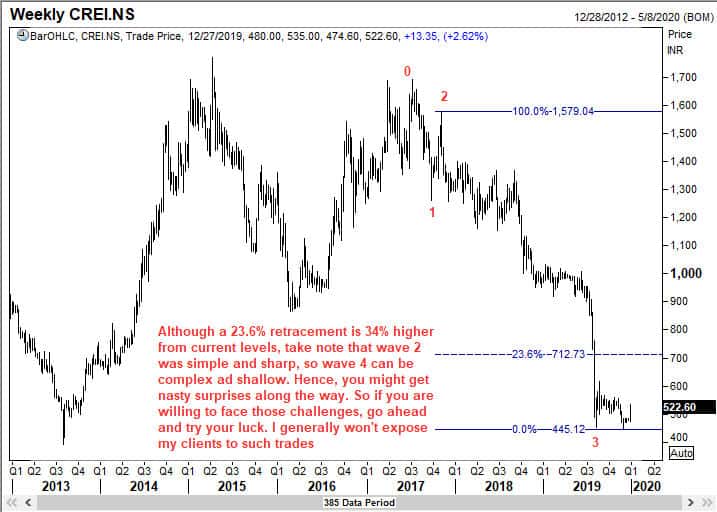

As noted on the chart above, it is perfectly possible that we get a recovery of over 30%. But what path with that journey take, especially if we are only in wave 4? Traders might get chopped trying to make a couple of percentage points. They will buy near a high thinking we shouldn’t miss a move, and cut their losses should it suffer from an unexpected dip, only to find that it starts climbing again. This is a typical experience of anyone who attempts to trade a complex correction. While there is no confirmed evidence that we are indeed in a complex wave 4, shouldn’t we take into consideration that possibility exists, and hence not expose ourselves too late in the move?

If you have learned this one lesson by reading this blog, then I am quite happy. Wave Times exists to help traders do better in their trading. I wish you all a Happy New Year! Are you aware of a 50% sale going on in my online program at ElliottWaves.com ? Don’t miss it. Give your new year the great start it deserves.