The stock in focus today is Shalimar Paints.

A picture is often worth a thousand words. In our case, it could be worth thousands of dollars!

Shalimar Paints is up 12% on Friday, May 12, 2017.

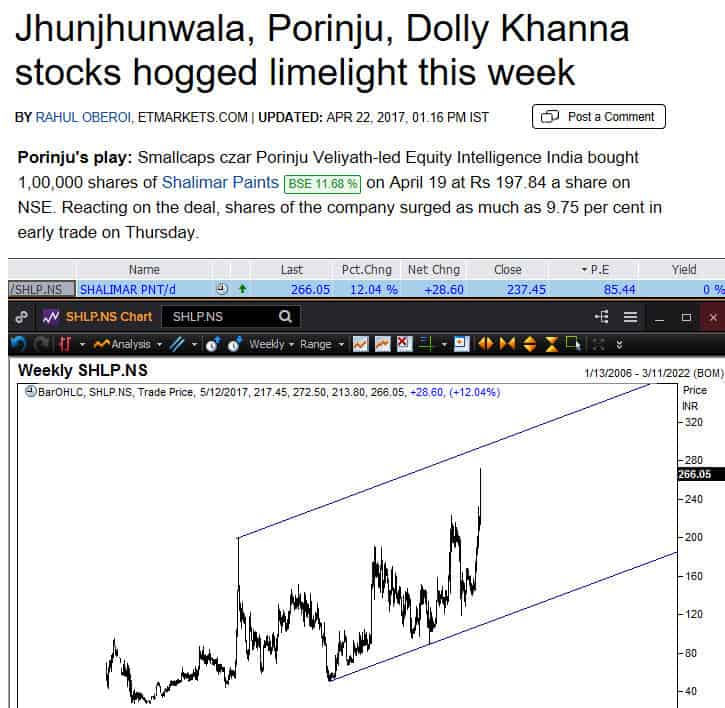

The headlines at the top of the image below is dated 22 April, 2017. And the stock is already up by 35% from the purchase price of Mr Porinju.

The people who are buying it here, at these lofty prices, must surely believe in a strong turn around story. Read, for instance, the article penned by Jitendra Kumar on MoneyCotrol here:

He points to some other financial ratios that put Shalimar Paints in a better light. The caveat is the company has to deliver!

A simple channel drawn as shown in the chart below will make anyone who is technically inclined cautious about buying here.

I wouldn’t be surprised if we start seeing some profit taking from 285 onwards!

Of course, I could be wrong, and this stock could be trading a lot higher in the years to come. Do you have deep pockets like Mr Porinju?

What percentage of his total portfolio is this one investment? If your planned exposure is of similar percentage, and your holding power is the same as that of Mr Porinju, then you may take a second look at this stock. Otherwise, buying an expensive stock is asking for trouble. Investors with a multi-year time frame will be reading reports such as the following, where Shalimar Paints is included. (Price of the report is USD 4,000, by the way)

But a bit of searching will reveal a slightly older report, which speaks of the opportunities available in this sector over the next several years:

http://www.grandviewresearch.com/industry-analysis/emulsion-polymer-market

Clearly, if Shalimar Paints is a turnaround story, then there is a lot of growth available. However, what price are you paying for that? Wouldn’t it make sense for you to wait for a quarter when the company announces a less-than-anticipated result and buy on the inevitable knee jerk sell off?