My last Elliott Wave workshop was done in Bangalore towards the end of April 2018. There, I used an example from my portfolio to demonstrate how to manage one’s medium-term investment using Elliott Waves. The stock in question was Dhampur Sugars, a stock that has rallied by nearly 60% in just the last 3 trading days.

I am only going to tell you part of the story here, because that example will still remain a case study in my next workshop.

Investing my first lot in Dhampur Sugars

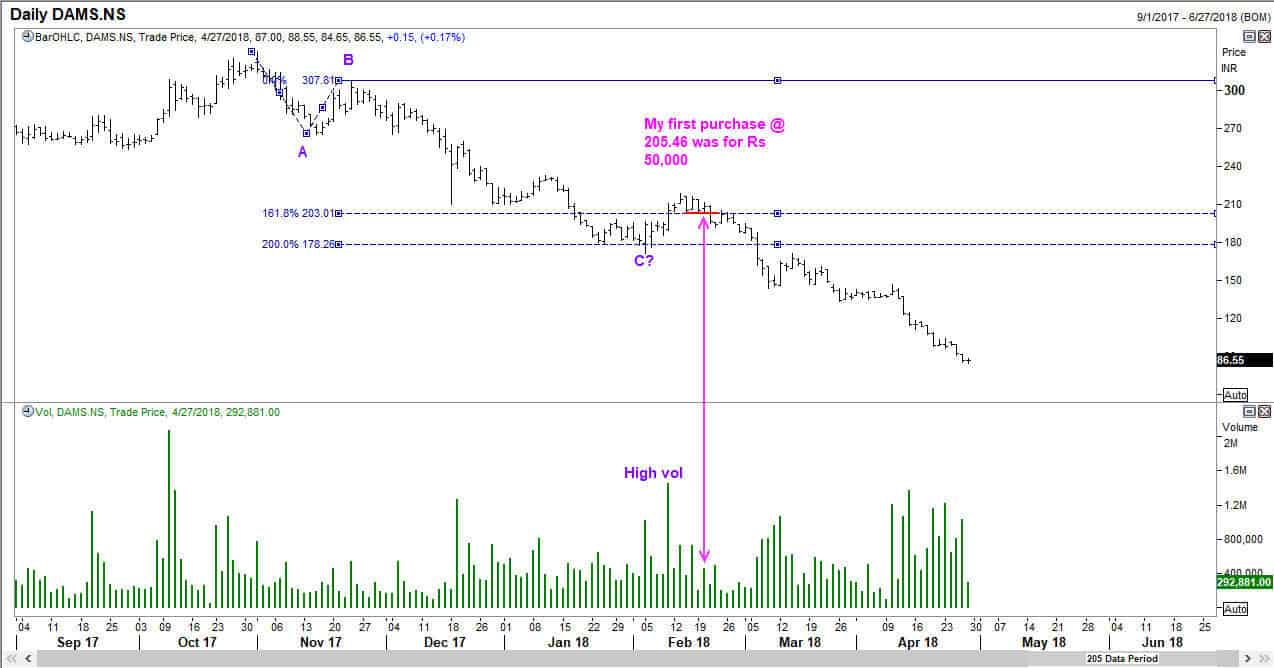

You might not believe it, but my first purchase was made in February 2018 at a price of Rs 205.46. The stock has since been to a low of Rs 71.70 (seen on 23 July 2018), a loss of over 65% in about 5 months! My purchase was not made at any random level. I had seen a 3-wave down move, where wave C was 200% of wave A. Then the stock had rallied by over 25% from that C wave low. And I bought the stock on a dip after seeing that a support level had held for 3 consecutive days! But I was also sensible. My goal was to invest Rs 2 lakhs in this stock, but I started off with just Rs 50,000. Remember, this is not a trading position!

Boy was that a smart investment! The stock promptly started coming off.

Investing my second lot in Dhampur Sugars

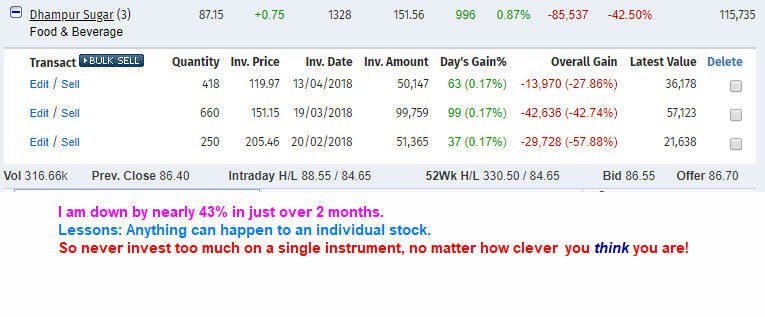

Dhampur sugars came down to 143.65, which is a 61.8% retracement of the prior bull run, and started climbing again. I watched it go to 170.80, which is 18% up from its recent lows, and then invested Rs 1 lakh at 151.15. Notice that this time I have invested twice the previous amount.

My Third Entry into Dhampur Sugars

Well, I have a method. And it works most of the time! I computed what could potentially be the end of Wave C and added Rs 50,000 at that point. On 13 April 2018, I made my third purchase at 119.97. By the end of the day, the stock had closed further down by 7%. And that was when I knew that I have become a truly LONG-TERM investor in Dhampur Sugars!

Here is what I showed the people who attended my seminar in Bangalore:

The other key take away for them was despite losing over 40% on this stock at that time, my portfolio was down by a mere 5%, and if I had removed my two worst performing stocks, my portfolio was down by only 2%.

You might think that I share only the best results on this blog and in my seminars. That is not true. I aim to teach you how to trade and invest smartly. Should I have held my Dhampur Sugars so long? Was that a smart move, smarty pants?

These are some of the stuff we will discuss in my next seminar, when I return from my overseas trip in October. But for you, readers of my blog, the take away is this. Elliott Wave is an approach to the markets. It is not a black box where you compute some Fibonacci ratios and get away making tons of money and retire in Hawaii. Yet there are few systems that work as well as Elliott Waves. In my next post, I will share with you one more example where a consulting client made over 20% in just a few short weeks.