I have finally found where the elusive comment on Gold was posted. As you will notice, that comment was posted on 7th April, and the low on Gold was 1443.49 on 12th April. (you might want to consider subscribing to the comments feed as well ;))

(the text of the comment appears at the bottom of this post again)

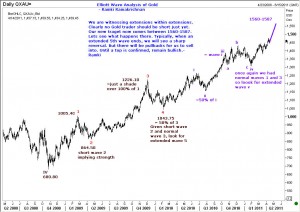

We are witnessing extensions within extensions. Clearly no Gold trader should be short just yet. Our new traget now comes between 1560-1587. Lets see what happens there. Typically, when an extended 5th wave ends, we will see a sharp reversal. But there will be pullbacks for us to sell into. Until a top is confirmed, remain bullish.

I would like to leave you with one final thought. The higher Gold goes the steeper will be its fall. So there will be enough room for even late comers to the bear party when it starts. But don’t make the mistake of selling on targets, as I have explained in the comment linked above. Best of luck! Ramki

Comment of 7 Apr 2011 reproduced: The mere fact of having reached a certain target does not mean the move is over. Certainly one should not contemplate selling just because a technical target has been reached. Ofcourse, it is certainly possible that Gold might have finished (or close to finishing) its rally. But until the time we have evidence that a top is in place, we should be ever so cautious. There are some supports at 1445 levels, and I wouldn’t be surprised at all if we get another attempt higher while this support holds. Only after we see a new 5 wave downmove finish will I start thinking about putting out a sell recommendation. How is this different from TCS where I appear to be comfortable in maintaining a downside target even before the top is definitively posted? I really can’t explain it. Sometimes I just feel it so. I realize that this is not a sensible answer. Maybe it is because TCS is doing a second extension within its 5 wave upmove? OK. Let me just say this. Once Gold finishes this rally, we will commence a decline down to 1160. Hope that satisfies some of you!