I decided to look at the Rubber Futures being traded at Singapore just for fun, and found some interesting details. Elliott Wave analysis of rubber futures seems to work just fine!

I decided to look at the Rubber Futures being traded at Singapore just for fun, and found some interesting details. Elliott Wave analysis of rubber futures seems to work just fine!

Key Rubber futures recovered last Friday as sentiment improved on a recovery in oil prices after a sell-off the day before. Firmness in other commodities also helped.

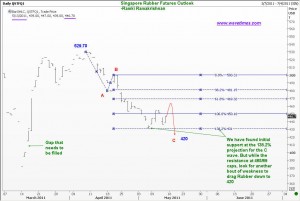

Wavetimes would like you to study two charts to appreciate how this commodity behaves technically. The first chart looks at the bigger picture to demonstrate how the futures price of the August 2011 contract of Rubber declined exactly to the key 70.7% retracement level (382) before staging a remarkable recovery to 529. The second chart shows you how the most recent sell-off stopped quite precisely at the 138.2% key Fibonacci projection level which marks an intermediate support.

The current recovery in Rubber futures from 431 is likely to run out of steam around the 465 levels from where a fresh bout of weakness can take the price down to around 420. Only a weekly close above 471 would trigger the need to reassess the technical picture.

-Ramki Ramakrishnan