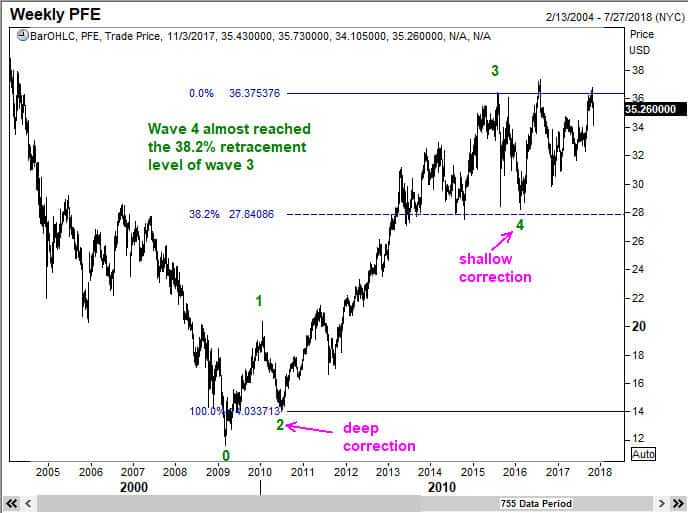

Pfizer (NYSE: PFE) has been in a bull run from March 2009, at which time the low was $11.62. Its most recent high was at $37.39. Let us now examine the price chart from an Elliott Wave perspective.

Wave 2 was a deep correction. This usually signals that wave 4 will likely be a shallow correction.

Wave 3 was extended to almost reach 261.8% of wave 1. We then got a wave 4 correction to the 38.2% retracement level of wave 3.

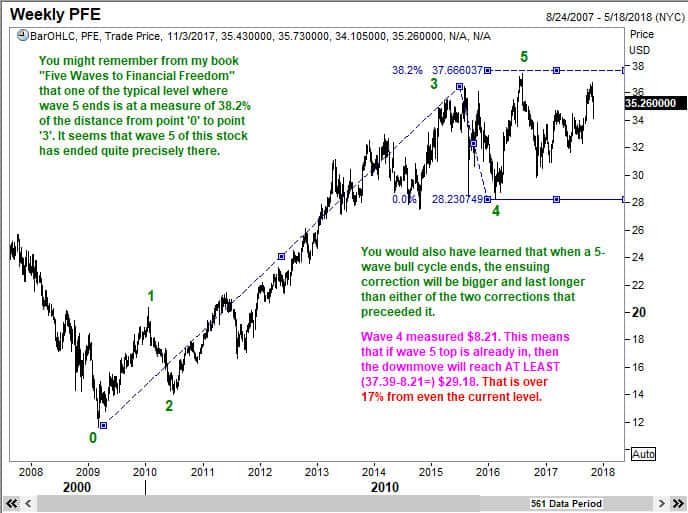

Wave 5 has reached 38.2% measure of the distance from point ‘0’ to point ‘3’. Thereafter, we got a decline to $29.83, a 20% fall. Perhaps the market is signaling that the bull cycle is over.

You might recall from the book “Five Waves to Financial Freedom” that once a five wave sequence ends, we will get a correction that is bigger than the larger of the two corrective waves seen during the bull phase. Wave 4 measured $8.21. So the correction from the $37.39 high should come down by more than $8.21 to reach at least 29.18. So far the low has only been 29.83. So there is a reasonably good chance that we will get one more push lower.

Remember that corrections tend to be in three waves. The first sell off to 29.83 was probably wave A. Thereafter, we have been going up as wave B.

Observe that within Wave B, sub wave c = sub wave a. Unless Wave B is still not over, in which case we might get a revisit to the top before Wave C commences, we should get ready for a direct move down.

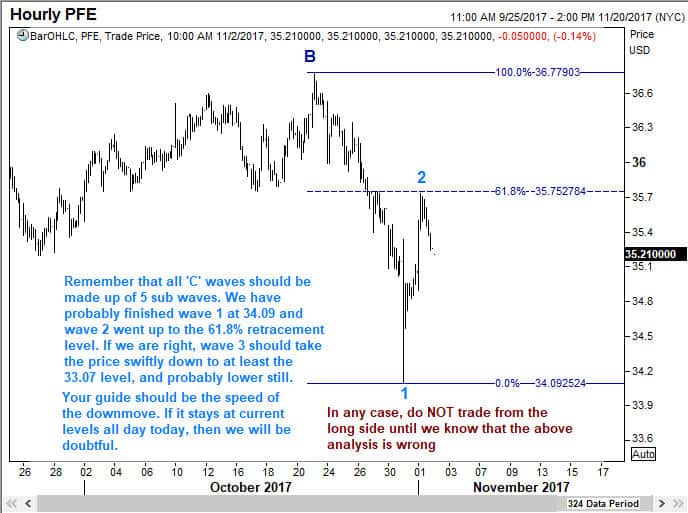

All C waves should be in 5 sub waves. Let us take a closer look at the moves that happened from the B wave top.

We have run into some resistance at the 61.8% pull back. That recovery should be just wave 2 within the C wave. The next sell off will be wave 3 inside the C wave. Remember that all third waves will be swift. So be ready to join in the selling the moment you see a quick downward action. However, being cautious is never a bad idea. Being patient until the selling starts allows you to side step any complex recovery back to the highs before the down move begins. Imagine we get a recovery back above 35.72. Carefully monitor its progression. Eventually it should turn back. When it does, watch the speed of the down move. The moment it trades below 35.72, and on increasing volume, you should sell without delay.

What could go wrong now? Well, the stock could keep going up. However that will not hurt us because we have a strategy in place. On the other hand, we know how far it can go down, and we know that when it starts its descent, the move will be rapid. This allows us to structure several kinds of trades, depending on your knowledge of derivatives and your risk appetite. At the very least, you will no longer be approaching this stock with a bullish intent for now, because of the vulnerabilities of the stock on the downside.

These are the very same thought process that I apply in choosing ideas for the members of the exclusive club of WaveTimes.