Opto Circuits India Ltd appears in many portfolios that have Bharat Shah as the advisor. (Incidentally, Bharat is the famed fund manager from Ask Investment Managers). As Bharat is a value investor, I figured that he and his team must have done sufficient research about the desirability to have this stock in their portfolio for the long haul. As I have recently decided to start investing in India myself, it made sense to look at each of the many stocks he has in his kitty. The first one I looked at is Opto Circuits.

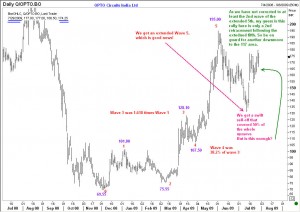

We all know that even if we select a good stock, the price we pay for it will determine our investment success. Thus, I am willing to wait for a level where I will be comfortable buying Opto Circuits. Take a look at the attached chart, where you will see Elliott Wave counts of this Indian stock. You will observe that after a five wave move higher from its lows, the stock has already corrected by 50%. However, if that dip was the 2ndwave, shouldn’t the next rally be substantially stronger (being a potential 3rd wave)? This is not the case. Clearly, we seem to be in the middle of a so-called second retracement that often shows up when we get an extended fifth wave. The bottom line is, using Elliott wave analysis, we can conclude that a desirable price to start accumulating OptoCircuits will be not before 118.00. Accordingly, I am going to set my alerts in Money Control to send me an email when we reach 120. Now don’t be surprised if this stock first goes to 220. I don’t care even if it goes to the moon. The time to buy this will be near 117. Cheers!