Copper prices are in the news again. The Wall Street Journal reports that Chinese data takes the credit for this. Chinese imports of refined copper rose by 2.4% in June from a month ago.. Copper’s fortunes are closely tied to China, which accounts for 45% of global copper consumption. As fans of Elliott Wave analysis, you might wonder if this approach was able to anticipate these moves. The answer is a resounding yes.

Back in November of 2016, a client had approached me for consultation on Copper, and I had sent him the analysis that you can download from this link: Comex Copper Analysis

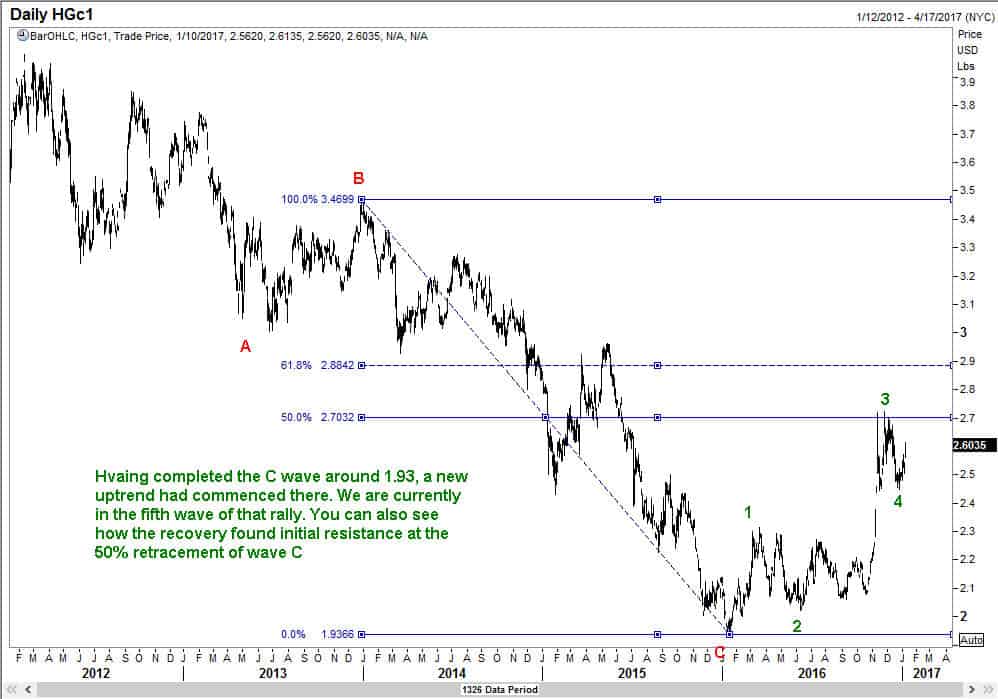

You can go back and check out how prices moved since that date, and I am sure you will be impressed with what Elliott Waves could accomplish. his was then followed up with another analysis in January, and I reproduce the charts for your learning.

Thus, it is possible to trade with an edge when you include Elliott Wave analysis in your armory.

All the best

Ramki