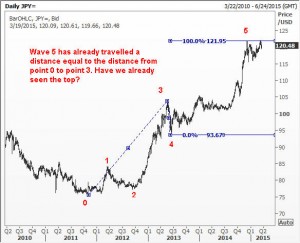

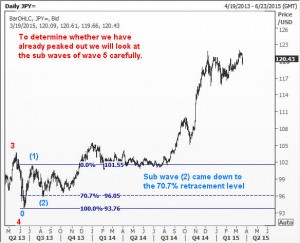

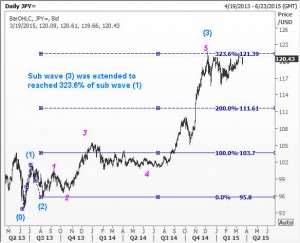

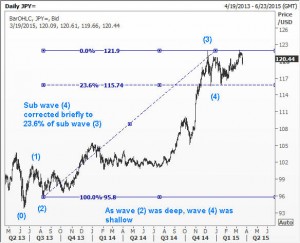

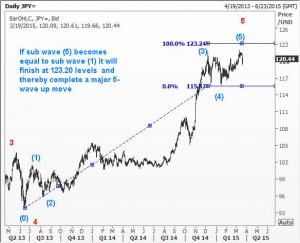

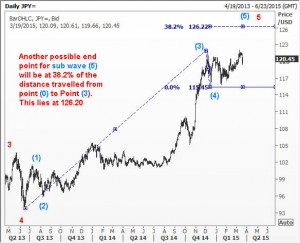

Elliott Wave analysis of USDYEN or JPY has not figured on WaveTmes for a long time. In fact, I haven’t published any currency analysis for a while. That is not to say I haven’t been looking at it. Treasurers of large corporations and hedge fund managers have been in regular touch. I present you with a bunch of charts on USDYEN which you can use as part of your learning. This blog exists to help you get better at interpreting the waves, and also as a living book, a valuable resource that compliments my Elliott Wave Book, Five Waves to Financial Freedom. I suggest that you open each Elliott Wave chart on a new tab! Enjoy.

Elliott Wave Analysis of USDYen (JPY)

Unleash your Potential

Transform your trading – Starting Today