Does Elliott Wave Principle work when Central Banks intervene? Remember that wave analysis is one of our tools for trading. We are not attempting to use this as a forecasting tool as much as we use it to decide ‘when’ to buy or sell (for a low-risk trade) and to determine how far a move can travel.

Does Elliott Wave Principle work when Central Banks intervene? Remember that wave analysis is one of our tools for trading. We are not attempting to use this as a forecasting tool as much as we use it to decide ‘when’ to buy or sell (for a low-risk trade) and to determine how far a move can travel.

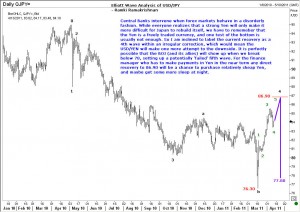

Central banks intervene when forex markets behave in a disorderly fashion. While everyone realizes that a strong Yen will only make it more difficult for Japan to rebuild itself, we have to remember that the Yen is a freely traded currency, and one test of the bottom is usually not enough. So I am inclined to label the current recovery as a 4th wave within an irregular correction. This would mean that USD/YEN will likely make one more attempt to the downside. It is perfectly possible that the BOJ (and its allies) will show up when we break below 78, setting up a potentially ‘failed’ fifth wave. In the meanwile, for the finance manager who has to make payments in Yen in the near term any recovery to 86.90 region will be a chance to buy some relatively cheap Yen, and maybe get some more sleep at night.