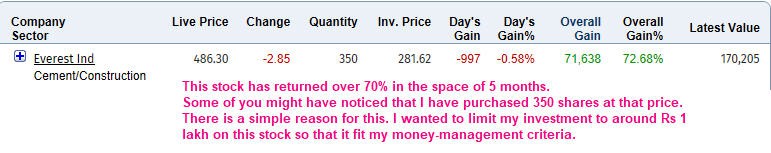

Everest Industries is a hot favorite among many investors. Here is a live trade in my portfolio. You can see how I think and act, the exact same methods I use for members of the exclusive club at WaveTimes. (Oh there is a trade that we considered closed just today. See wavetimes.net .Will publish details of that after a few days, once all members have taken their profits).

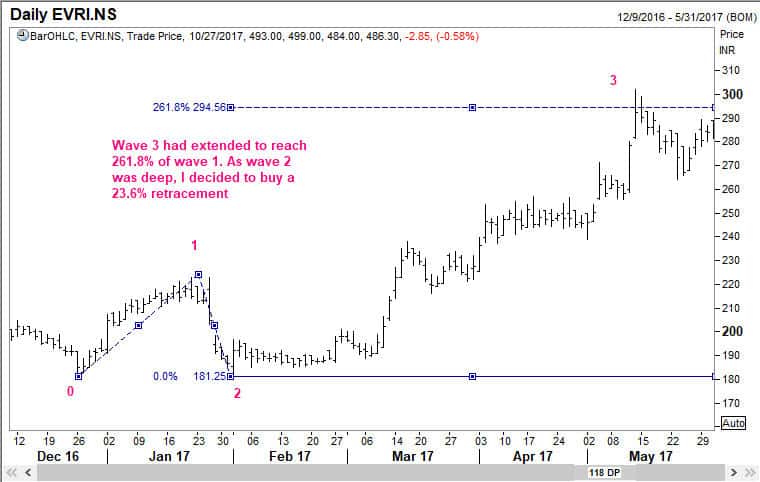

As always, there is no need to write an essay when a picture can speak a thousand words. My comments are on the charts.

Determining where we are in Everest Industries Ltd

Taking the plunge in Everest Industries

You will see later from my portfolio screenshot that I entered only part of my planned position here.

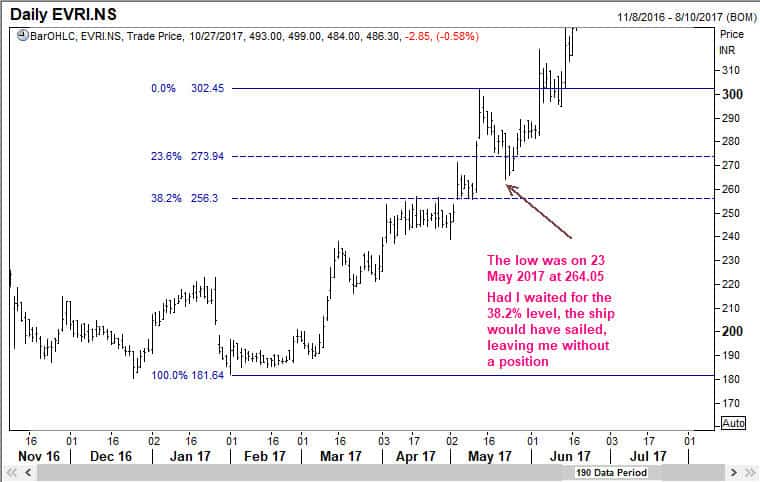

Everest Industries did not reach my second buy level

Trading is always taking a bet against what the market is doing. I need to place a buy order when others are selling. I should be prepared for the price to move lower still. Otherwise, I will never have a trade. Some other times, the market will not reach my buy level, as it happened for my second lot.

Why arm-chair analysts don’t succeed

Most Elliott Wave Analysts are focused on the wave counts. Their goal is to either show-case their wave counting prowess, or to give themselves an ego boost when things turn out right. I know because I have been in that phase much earlier in my career that dates back to 1984. We should have a strategy when we decide to enter a trade, and am happy to say that WaveTimes has been executing that strategy remarkably consistently. Ask your friends who are members!

I close this post with a final screenshot. This blog aims to teach you how to use Elliott Waves. You can learn a lot more from my book, “Five Waves to Financial Freedom“, and of course from a seminar or workshop that I occasionally conduct around the world. Good luck!