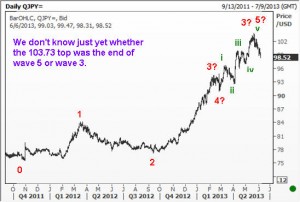

Hello Traders, Its been a few weeks since I updated this blog. Incidentally, I had not suggested any trade to the members of the Exclusive Club also for quite a while (if you leave out the trade on an Indian Stock that reached within a whisker of its profit objective). There is no need to be super active in order to make money! The best trades are those where you know the odds of success are stacked in your favor. I try to be patient for those set ups. Last Thursday, I spotted such an opportunity in USDYEN and I am happy to share parts of that with you. You can see from what follows below that trading is a completely different game from doing analysis. Regular readers of my blog (and my responses to comments) would know that I have always maintained that the Raison d’être for any analysis should be to make money, not to showcase one’s ability to come up with fancy charts! A key advantage that I enjoy is my knowledge that the markets can do whatever it wants, no matter how clever I try to be! Armed with that knowledge, I can sidestep some of the traps that snare most traders. This is not to say that I haven’t experienced any losses. It is just that these losses are less frequent and usually quite small compared to the winning trades. What follows is how I began my trade idea. 6 June 2013 I started preparing for this update when the USDYEN was at 98.52 around 6.30pm my time. Around 6.50, my wife reminded me that I have to go for my walk. The Yen was trading at 98.09 by then. You can see the last prices on the 3 charts. About 40 minutes later, it was already below 96! Such is the power of a C wave or a 3rd wave. You CANNOT afford to stand in its path. Of course, you could have positioned short, but that is ‘what could have been’ not what we need to do from now. Anyway, the key lesson for you is when a 3rd wave or C wave is developing, NEVER, NEVER try and pick obvious supports to go against that move. Now for the trade idea. By the time I am writing this, the USDYEN has bounced back to 97.23. In case it stops around 97.30 and starts coming off, there is a reasonably good chance to retest the 95.95 low, and possibly break it to reach 95.60. I suggest that you be patient for that move to happen. Place a small buy order at 95.82 and add some more at 95.62. Your stop can be placed at 95.40, risking some 30 pips. You are looking for a move back to 97.30 at least.

A little later I added an update that suggested that while we were waiting for the dip to our supports, we might head higher and if we see 97.65, we can actually sell there with a stop at 97.80. The USDYEN went only as high as 97.49 and from there it collapsed to a low of 95.53. We were now long of USDYEN. The recovery from there went to a high of 97.24, but I sent out an alert that we should take profits on part of the position at 97.05. Later on, when the USDYEN was around 96.70, I once again warned traders that we should get out of all remaining longs because the wave structure indicated another sell-off was ready to happen.The USDYEN subsequently declined to a new low of 95.02 before rallying strongly again. The key take away for you should be the following. Elliott Wave analysis is a great tool for traders. But you will be better off if you realize that it requires a lot more than an ability to compute Fibonacci ratios in order to make money at the market. All the best.