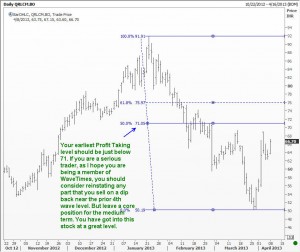

Hello Traders, In this Elliott Wave update, I am presenting you with a trade idea that was shared with the members of the exclusive club about 10 weeks ago ( April 4 to be precise). That trade idea was to invest in Reliance Communication and I am happy to note that today the stock has returned 100% profits to those who have held it in their portfolio. The reason for posting it in this blog is solely to demonstrate how one should go about using Elliott Waves. This blog seeks to teach you that. Enjoy.

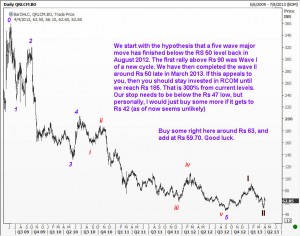

4 April 2013 Many of you have been following my recommendation on Reliance Communication on my blog. The recent news about the rapprochement between the Ambani brothers augurs well for this stock, and the technical picture supports this view. Take a look! Good luck.

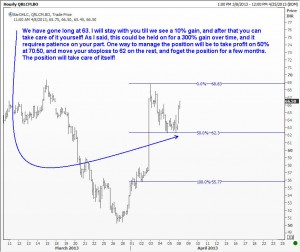

8 April 2013 I wonder if you have read my book “Five Waves To Financial Freedom”. In one of the chapters there, I have described a common scenario where a trader waits patiently for a 2nd wave and buys a stock. It starts moving in his favor, and he watches rubbing his hands with delight. But quite suddenly, something happens, and the stock starts coming off, this time it breaks below his purchase price. Our trader’s mood swings from joy to despair. He cannot bear to see his paper profit all vanish, and now he sees a paper loss. Of course, his original stop loss is still far away, but that is a different thing. In his mind, all that matters is he has lost all profits that he could have made, and now he has the compulsive urge to cut his loss before it runs away. So he either immediately gets out, or he gets out as soon as he sees a break-even price. After a few sessions, the stock roars higher, leaving him in the dust. Our trader tells anyone who would listen, including his wife, friends and his cat/dog that he was long at the right level, but was shaken off by the stupid market. I am narrating this story because you should not make the same mistake. We had 2 buy levels for RCOM. The first one was done, but if it dips again to the second level, you should still consider buying there. Don’t rush to sell! If your stop loss is done, well, that is the price of trading the market. You cannot hope to trade without expecting to lose some trades. But if you sit on your hands for most trades, and get into one when you feel you cannot wait any longer, then that is the trade that will most likely result in a loss! Be consistent, trade amounts that wont bother you too much if it results in a loss. *But trade a size that makes sense*. You cannot invest Rs 10,000 in a trade, pay me $50, pay the brokerage etc and still hope to make money. This is why I had said that members of this exclusive club are not meant to be small traders. You should know what is the correct position size for any trade. This size depends on your individual financial situation. You should know already that money is there in the markets for the intelligent trader. Take all trades, and over time you will see your bottom line is growing nicely. Good luck.