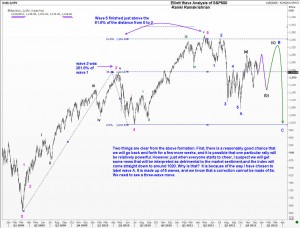

Two things are clear from the attached chart. First, there is a reasonably good chance that we will go back and forth for a few more weeks, and it is possible that one particular rally will be relatively powerful. However, just when everyone starts to cheer, I suspect we will get some news that will be interpreted as detrimental to the market sentiment,and the index will come straight down to around 1020. Why is that? It is because of the way I have chosen to label wave A. It is made up of 5 waves, and we know that a correction cannot be made of 5s. We need to see a three-wave move.

Two things are clear from the attached chart. First, there is a reasonably good chance that we will go back and forth for a few more weeks, and it is possible that one particular rally will be relatively powerful. However, just when everyone starts to cheer, I suspect we will get some news that will be interpreted as detrimental to the market sentiment,and the index will come straight down to around 1020. Why is that? It is because of the way I have chosen to label wave A. It is made up of 5 waves, and we know that a correction cannot be made of 5s. We need to see a three-wave move.

Just for a moment imagine that I have labeled it all wrong, and the correction actually finished at the point marked A. What does that mean? It means we have embarked on a third wave, which should be steeper than the first wave. Also, the third wave should travel quite a distance! Given the current uncretainties in the market, this seems unlikely. Besides, the correction of the prior five wave rally that finished above 1350 seems inadequate.Thus, I am professing the view that we will see a move down to 1020 early next year.

Your next question is why am I anticipating a relatively powerful rally that will fail to live up to its promise? It is because the move that you see labeled in black as (a) was made of 5 smaller waves, and for the same reason I explained above, (that a correction cannot be made of 5 waves) we need to see a (c) wave posted. And because that set of (a)-(b)-(c) together is deemed a B wave of the next degree, we will see some traders left stranded up there. Let us see how all this turns out.

Happy new year, and best wishes to you and your families.