It is time to take a fresh look at the medium term outlook for the EUR/USD (Euro). My last update was exactly a month back (in February), but that gave a short-term outlook for the Euro (using the hourly chart) and the January update was looking at an even still shorter term (using the 10 minute charts!)

It is time to take a fresh look at the medium term outlook for the EUR/USD (Euro). My last update was exactly a month back (in February), but that gave a short-term outlook for the Euro (using the hourly chart) and the January update was looking at an even still shorter term (using the 10 minute charts!)

Those who have been trading the EUR/USD would know that our approach to the market using Elliott Wave Principle worked quite well in both these time frames.

Some of my large Corporate clients have requested for a longer term outlook and I thought it is a good time to share my thoughts with you too. By the way, I worked on my charts before I even read the news, and it is a good idea for you to know what the ECB President had to say: Among other things, he said “ECB’S TRICHET-EXCESS MOVEMENTS IN FX RATES HAVE ADVERSE IMPLICATIONS” – nothing new there! On Thursday 3rd March it was reported “ECB’S TRICHET SAYS RATE HIKE IN APRIL POSSIBLE, NOT CERTAIN, WE ARE NEVER PRE-COMMITTED” but on Friday he countered with “SOLID DOLLAR IS IN THE INTEREST OF INTERNATIONAL COMMUNITY”. Perhaps he wants to hike rates, but doesn’t want the Euro going up too quickly? Anyway, let us turn now to what our charts say.

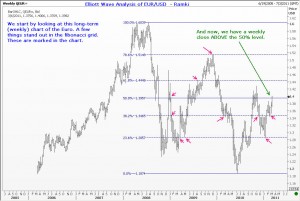

The weekly chart has become more positive with the close above the 50% retracement level. Of course, two closes will be more weighty, but that is too far away. We need something NOW, don’t we!

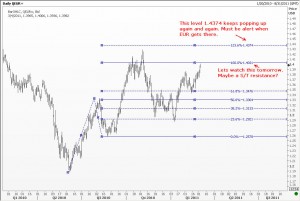

In my view, the medium term outlook for the EUR/USD is still up. I think we will at least retest the prior high at 1.4280 with a decent chance to visit 1.4374. More comments on the charts.

By the way, have you been to my facebook page yet? It is a great way for you to exchange notes with others who follow the markets. I also have a twitter account @wavetimes in case you are interested.